As its merger with London-based merchant acquirer Worldpay Group plc gets closer, payment processor Vantiv Inc. reported Thursday that it saw strong growth in its merchant-acquiring segment in the third quarter, especially from small and mid-sized merchants. Symmes Township, Ohio-based Vantiv said net third-quarter revenues in its Merchant Services segment …

Read More »P2P Specialist Zelle Adds Partners and other Digital Transactions News briefs from 10/26/17

Zelle, the person-to-person payments service from bank-owned Early Warning Services LLC, added ACI Worldwide, CGI, D3 Banking Technology, and IBM to its list of processor and technology partners that enable their financial-institution clients to offer Zelle to consumers. Processor Fiserv Inc. said Regions Bank will offer digital money-movement services, including …

Read More »Eye on Innovation: Sound Payments; Vantiv’s Smart Pay Play; New Bill-Pay Vistas

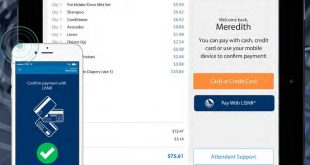

A Cincinnati-based startup called LISNR is promoting technology that transmits payment data over sound waves. The technology, which the company demonstrated Tuesday at the Money 20/20 financial-technology conference in Las Vegas, is now open for beta and can be used as an alternative to near-field communication, the company said. It …

Read More »PCI Council Leadership Shifts Gears, and the Organization Adds 3-D Secure Standards

The PCI Security Standards Council is without a general manager as the organization that establishes electronic-payments security standards prepares to go in a new direction with its leadership. Out is Stephen W. Orfei, who joined the council in 2014 as general manager and replaced Bob Russo, the council’s original G.M. …

Read More »Visa Kicks Out Handsome Profits, but CEO Kelly Admits To Being ‘a Bit Paranoid’

The Visa Inc. transaction machine continued to spit out profits in the payment network’s final quarter of fiscal 2017, but chief executive Alfred F. Kelly doesn’t want anyone to think he ignores competitive threats such as the rise of China’s Alipay or real-time payment services from other companies. “I think …

Read More »Pulse Volume Jumps 17% and other Digital Transactions News briefs from 10/25/17

The Western Union Co. early next year will start allowing money transfers via Mastercard Send, a service that allows people to send money within seconds from a debit card to another person’s debit card, including non-Mastercard cards. Senders can also fund transfers with credit cards or bank accounts, but must …

Read More »Americans’ ‘Password Hygiene’ Is Getting Worse, International Study Finds

Despite non-stop news reports about data breaches, Americans over the past year have gotten sloppier about their usage of passwords to protect their financial accounts online. That’s the word from research firm Aite Group LLC and Visa Inc., which recently announced results of their second annual Global Security Engagement Scorecard …

Read More »First Data Adds UnionPay Acceptance and other Digital Transactions News briefs from 10/23/17

Facebook Inc. has joined Visa Inc.’s Digital Enablement Program, giving the social-networking giant access to tokenization services globally. First Data Corp. said it will add UnionPay International acceptance to its merchant network, enabling UnionPay cardholders traveling as tourists in the United States to use their cards in stores and online. Eventually, …

Read More »Joe Kaplan Moves to Sage and other Digital Transactions News briefs from 10/23/17

Private-equity firm GTCR, which bought Sage Payment Solutions in August from its British parent company The Sage Group plc, appointed veteran independent sales organization executive Joe Kaplan as chief executive of the merchant processor, and also announced that it would invest $350 million to support Sage. Kaplan is the former …

Read More »Merchants in a Quandary Balancing Fraud Reduction and Higher Transaction Volume: Report

Almost as many merchants—65%—seek to increase transaction volumes by reducing identity verification thresholds as do those—74%—that try to reduce fraudulent transactions through more effective verification methods. That quandary surfaced in the “Lost in Transaction Vol. II” report released Thursday by Paysafe Group plc. With a focus on fraud, including consumer …

Read More »