As financial institutions help their customers counter fraud, Feedzai is releasing a tool to help FIs better identify potential scams. Dubbed ScamAlert, the service, which incorporates an artificial-intelligence utility, can help identify tactics criminals use to exploit consumers. Many consumers may initially fall for a scam through a phishing email; …

Read More »PayMaple Adds Real-Time Payments and other Digital Transactions News briefs from 3/12/25

Payments platform PayMaple LLC launched a new accounts-payable service enabling vendor payments via real-time payments, the automated clearing house, or virtual cards. The last option is expected by the third quarter, the company says. Vitesse, a specialist in claims payments for the insurance industry, is working with Five Sigma Ltd., a claims-management …

Read More »Dwolla Launches Open Banking Via Its Plaid Integration

Account-to-account payments provider Dwolla Inc. has launched an integration to open-banking platform Plaid Inc. The integration is expected to enable Dwolla users to verify accounts and check account balances in real time through a single vendor and application programming interface. Dwolla announced its partnership with Plaid late last year. The …

Read More »Cash Use Slips As Digital Payments Grow, Says Worldpay Survey

As credit and debit cards—and their digital doppelgangers—continue to find favor among consumers, the use of cash over the past 10 years has slipped from 44% of in-store spend to 15% in 2024, finds the latest Worldpay Global Payments Report. Released Tuesday, the report, now in its 10th year, says …

Read More »Visa’s New Scam Disruptor and other Digital Transactions News briefs from 3/11/25

Visa Inc. introduced its scam-disruption practice, aimed at identifying and preventing scams “as they emerge,” the company says. Just 26% of credit card holders are “satisfied” with their cards, while 24% are “dissatisfied” and 50% are “indifferent,” according to a survey of 8,000 cardholders age 18 to 45, plus 200 senior …

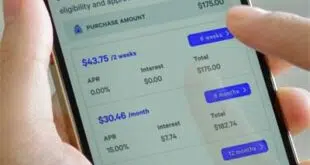

Read More »Affirm Extends Its Reach With Apparel Retailers; Splitit Offers a Digital Wallet

Buy now, pay later specialist Affirm Holdings Inc. continues to expand into fashion merchants through a partnership with online fashion-marketplace StockX. Apparel merchants are a fast-growing merchant category for Affirm. The BNPL provider has added 55 apparel sellers in the past six months, including StockX. In addition, transactions in its apparel and …

Read More »Eye on E-Commerce: Wildfire’s New White-Label Shopping Portal; Best Buy Canada’s Cross-Border Payments Pick

With e-commerce sales accounting for 16.4% of all U.S. retail sales in the fourth quarter, Wildfire Systems Inc. is hoping its new white-label shopping portal will enable more merchants to take advantage of the shopping channel. In related news, retailer Best Buy Canada will use PingPong as its first cross-border payment …

Read More »Shift4’s Lunchbox Stake and other Digital Transactions News briefs from 3/10/25

Shift4 Payments Inc. has chosen ordering-technology provider Lunchbox Technologies as a partner for Shift4’s SkyTab platform and has also invested in the company. The extent of the investment was not disclosed. Meanwhile, Lunchbox has appointed hospitality-industry veteran James Walker chief executive. Ingo Money Inc. said its Ingo Payments service agreed to work …

Read More »AmEx Adds an Expense Management Platform Via Its Center Acquisition

American Express Co. has acquired software developer Center. Terms of the deal, announced late Thursday, were not disclosed. The acquisition is expected to close in the second quarter. The deal will provide AmEx’s corporate and small-business cardholders with an integrated expense-management platform that delivers real-time visibility into all employee spending, …

Read More »For Many, It’s Device First To Make a Contactless Payment

Ten years ago, the U.S. payment card market made its shift to EMV chip cards, and along with that the industry prepared for more contactless payments. That work by issuers and card brands appears to have paid off because 92% of consumers are now familiar with NFC, the technology that …

Read More »