Payments fraud takes many forms, forcing banks and processors to adopt fresh tactics. But sometimes the technology to prevent fraud can be expensive enough to wipe out any near-term expectation of return. Early Monday, Oracle Corp. launched Oracle Financial Services Compliance Agent, a platform it says can leverage artificial intelligence …

Read More »Busey Enlists Corserv for Card Program and other Digital Transactions News briefs from 4/8/24

Corserv, a payments provider for banks and fintechs, said it will work with Busey Bank to launch a credit card for the bank’s commercial clients. Synchrony Financial said BRP US Inc., a powersports and marine products maker, said it will Synchrony’s installment finance service to its dealers. The big France-based processor Worldline said …

Read More »Eye on AI: PayBlox Enlists AI for Statement Reviews; Colleen AI Tackles Rentals with Voice AI

The promise of lower credit and debit card processing fees is a big attraction for merchants to switch merchant providers. Statement reviews are a key part of that process and now PayBlox, a merchant services referral site, has enlisted artificial intelligence to help. With the debut of its Statement Spy …

Read More »Mobile Wallets and Contactless Payments Growing in Popularity, NFC Forum Says

Consumers are not only favoring contactless payments more, they are relying more on their mobile wallets to initiate payments, according to the NFC Forum’s bi-annual Near Field Communication Usage and Adoption study. The study, conducted by ABI Research, reveals that 95% of respondents have left their physical wallets at home …

Read More »Skipify Working with Visa’s Digital Commerce Program and other Digital Transactions News briefs from 4/5/24

Checkout fintech Skipify said it is working with Visa Inc.’s Digital Commerce Program on initiatives, among them letting Skipify users link Visa Click to Pay cards to a Skipify’s Connected Wallet. This move speeds recognition of Skipify users on e-commerce sites to more quickly show the users’ available cards. PSCU/Co-op Solutions, a …

Read More »Klarna Launches a Web Page to Rebut the Idea That BNPL Burdens Consumers With Debt

Looking to dispel criticism that buy now, pay later loans are predatory-lending products, BNPL provider Klarna AB has launched Wikipink, a Web page that details information about its BNPL business, such as repayment rates, late fee rates, and consumer demographics. “By publishing our facts and figures with full transparency, including …

Read More »PayPal And Ripple Launch Stablecoin Initiatives As Crypto Values Rise And Plummet

The wild—and somewhat unpredictable—swings in value that beset digital currencies have begun to lead major payments players to consider a promising alternative: stablecoins, so named precisely because their values are pegged to a national currency, such as the U.S. dollar. Early on Thursday, PayPal Holdings Inc. and Ripple Labs Inc. …

Read More »NAB’s Visa Integration and other Digital Transactions News briefs from 4/4/24

Payments provider North American Bancard LLC said it has integrated its merchant processing platform with Visa Inc.’s Visa Acceptance Platform, allowing it to offer merchants access to Visa properties such as Cybersource, a fraud-detection platform. The Clearing House Payments Co. LLC said first-quarter volume on its RTP real-time payments network set a quarterly …

Read More »Mastercard Plans a Network Fee Hike for Later This Month. Merchants Aren’t Happy

Mastercard merchants will see a network fee increase later this month when Mastercard increases its Acquirer Brand Volume Fee from 0.13% to 0.14%, effective April 15. The increase comes on the heels of last week’s settlement between Visa and Mastercard, on one hand, and merchants, on the other, in their …

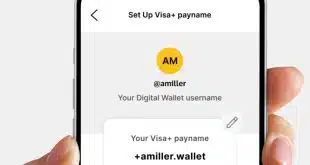

Read More »PayPal And Venmo’s Visa+ Entry Could Aid Interoperable P2P Payments

Enrolling PayPal and Venmo into the Visa+ interoperable peer-to-peer payments system may help foster even more P2P transactions, an analyst says. Visa Inc. earlier this week announced the two P2P wallets from PayPal Holdings Inc. had been enabled in the United States for Visa+. Users can sign up for a …

Read More »