Rohit Chopra, director of the Consumer Financial Protection Bureau, spent his Sunday afternoon highlighting key elements of the CFPB’s new data-privacy rule and criticizing banking organizations that have targeted the rule. The assault on the regulation includes a lawsuit filed the same day the final rule, in development for more than two years, was released.

Filed Oct. 22 by the Bank Policy Institute and the Kentucky Bankers Association, the lawsuit alleges the CFPB has overstepped its bounds by issuing a rule that fails to properly safeguard consumer accounts and financial data accessed by third parties, such as fintech and data aggregators, and puts at risk the infrastructure banks have built to support opening banking.

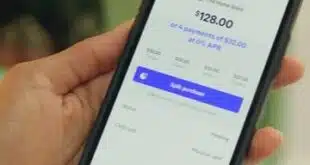

The new rule will require financial institutions, credit card issuers, and other financial providers to share data at a consumer’s direction with companies offering competing products. As a result, consumers will be able to access, or authorize third-party access to, such data as transaction information, account balances, information needed to initiate payments, upcoming bill payments, and basic account verification data. Financial-services providers will be required to make such information available free of charge to consumers.

Noting that it’s no surprise the largest players are the ones that want to slow and stop the CFPB’s rule, Chopra said he hasn’t read the lawsuit. “I haven’t read the lawsuit and I don’t think they read the rule,” he told attendees at the Money 2020 event in Las Vegas this week. He noted the lawsuit was ready to go as soon as the final rule was released

“It’s been over a decade since we passed a law saying that consumers would be able to really get some control over the data that’s locked up by some of the biggest financial incumbents who wanted to keep a very, very tight grip on that,” Chopra said.

Chopra said one of the primary goals for the rule is to foster innovation and avoid having one or two organizations controlling most of the market.

“We’re really at the precipice right now when it comes to payments,” he warned. “If you look at China, you really have a couple of actors that really dominate all of retail payments. I think you really want there to be a world without that kind of power or surveillance or censorship. So, [a] world we can create with lots of different rails and lots of choices for merchants and for consumers, that’s good.”

One of these payment rails could be undergirded by open banking, or, as defined by Mastercard Inc., the ability for consumers to securely share their financial-account data to access financial experiences. The CFPB has said the new rule is meant to move the United States closer to having a “competitive, safe, secure, and reliable” open-banking system.