Shoppers financing purchases during 2023’s Black Friday weekend are paying off their loans sooner than they were a year ago. Some 30% of BNPL purchases made during that period in the United States were paid off early, compared to 24% a year earlier, according to BNPL provider Klarna AB. Overall, 96% of BNPL purchases during Black Friday weekend were paid off on time or early.

The repayment trend is a reversal of the high delinquency rates BNPL providers were experiencing in 2021 as consumers flocked to the loans to finance purchases.

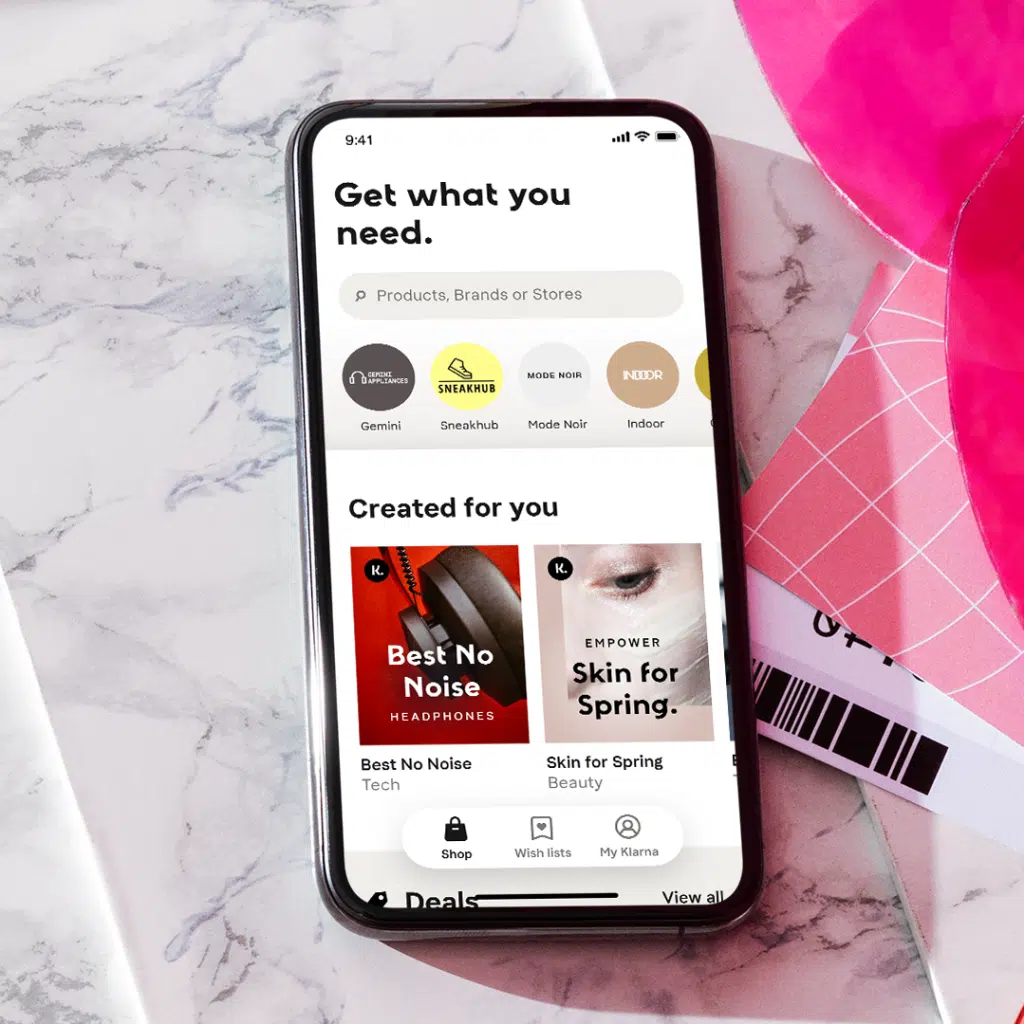

In addition, consumers relied more heavily on BNPL to finance Black Friday purchases. Klarna saw a 30% increase in the number of purchases financed with BNPL on Black Friday in the U.S., which the company says is a strong indication that consumers are moving away from credit cards to finance purchases.

The positive repayment trends for BNPL loans run contrary to the strain consumers who revolve balances on credit cards are feeling, according to Klarna. Some 47% of consumers making a purchase with a credit card during the 2023 holiday shopping season anticipated difficulties paying off their purchases in full on the due date.

This financial strain is adding to consumers’ mounting credit card debt. Consumers in the United States owe $1.13 trillion on their credit cards, according to the Federal Reserve Bank of New York. During the fourth quarter of 2023, consumer credit card balances ballooned $50 billion, the report says.

Of the consumers revolving a credit card balance, about one-tenth are paying more in interest and fees annually than they are towards their loan principal, trapping them in persistent debt, the Consumer Financial Protection Bureau contends.

“This data clearly shows that consumers understand Klarna’s BNPL products, underscoring the growing demand for BNPL services and the effectiveness of our BNPL model, while also demonstrating the financial prudence of our 37 million U.S. consumers who are looking for financial flexibility without compromising their financial health,” argues Erin Jaeger, head of North America for Klarna, in a statement.

Klarna has more than 37 million customers in the United States, a 32% increase from a year earlier. Consumers 50 and older represent the fastest-growing demographic among BNPL users, Klarna says.

“Klarna’s products are not built on encouraging people to borrow as much as possible at the highest possible rate like credit card providers,” Jaeger says. “When it makes sense to use credit, our interest-free BNPL product, with short-term repayments and no revolving credit, presents a fairer, more sustainable choice. This approach results in our users maintaining an average balance of $150, far below the $6,000 often seen with credit cards.”