Demand for digital-payment and embedded-finance technology is growing in the United States, especially among Gen Z and Millennials, says a report from payments platform Marqeta Inc.

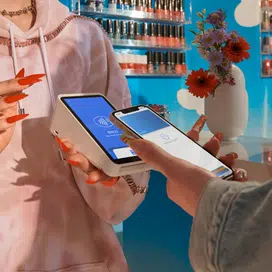

The demand is being driven largely by the lower adoption of contactless payments and mobile-banking apps in the U.S. compared to the United Kingdom and Australia, according to Marqeta’s 2024 State of Payments Report.

When asked whether they have used a contactless card in the past seven days, 46% of U.S. respondents said yes. By comparison, 80% of U.K. respondents and 59% of respondents in Australia responded affirmatively, the report says.

When asked about their mobile-banking usage over the previous seven days, 56% of U.S. respondents said they have used their mobile banking app during that period, compared to 71% in the U.K. and 67% in Australia.

Marqeta surveyed 4,000 consumers in the U.S. (2,000), the U.K. (1,000), and Australia (1,000) in June.

While adoption of modern payment methods in the U.S., such as contactless cards, lags that in the U.K. and Australia, U.S. consumers aged 18 to 34 are not only primed to adopt modern payment solutions, but do so from non-traditional payment-solutions providers. Some 63% of respondents in the U.S. aged 18 to 34 say they would get financial services from a non-traditional provider, including a social-media platform, retailer, or tech brand, compared to 42% of all U.S. consumers surveyed, according to the report.

When asked how they feel about brands offering financial services, 66% of U.S. respondents aged 18 to 34 say they are open to such offerings. Overall, 78% of all U.S. respondents say they use at least one additional financial provider outside of their primary traditional bank, a trend that demonstrates consumer openness to non-traditional providers and digital banks, the report says.

Based on the data, the report concludes that U.S. consumers aged 18 to 34 are seeking “fundamental changes” in how they manage their finances and get paid, which is challenging banking and financial-service providers to innovate.

“These preferences are indicative of a shift toward personal financial ecosystems, where consumers’ personal lives and financial lives merge and coexist in a faster, more user-friendly, more personalized, and more interconnected environment facilitated by embedded payments,” the report says.

Another payment option in the U.S. gaining momentum is instant payment for earned wages as the so-called gig economy continues to grow. Some 24% of U.S. respondents consider themselves part of the gig economy. That figure grows to more than one-third among respondents aged 18 to 34.

Among gig workers in the U.S., 87% say they are attracted to platforms that offer instant-pay options, according to the report. Among U.S. respondents aged 18 to 34, 37% say instant earned-wage access is a necessary benefit, compared to 25% of total respondents.

That trend is being driven in large part by the fact that 77% of U.S. gig workers say they are living paycheck to paycheck. Some 90% of U.S. gig workers surveyed say that immediately receiving their earned wages makes it easier to plan their finances, the report adds.

“[Earned wage access]is popular with the gig-worker sector, but has yet to reach critical mass with others,” the report says. “Regardless, spiking adoption among consumers between the ages of 18 and 34 promises to bring a tsunami of change in this area.”

The report goes on to conclude that “As younger generations enter the shift/gig workforce, the demand for flexible, digital financial solutions will rise. This represents a call to action for banks and financial-service providers to facilitate substantial changes in how these workers can manage their finances and get paid.”