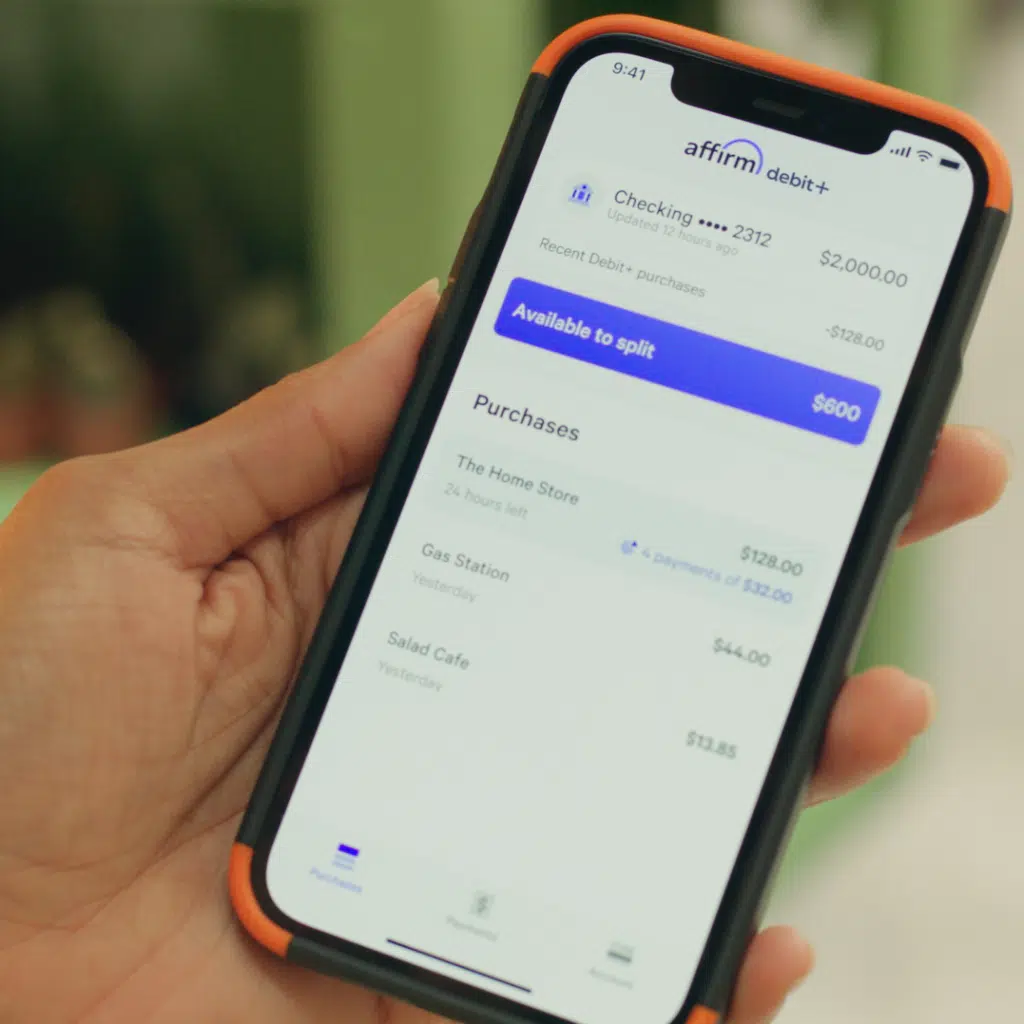

BNPL providers are expanding the utility of the payment option by enabling consumers to finance gift card purchases. BNPL provider Affirm Holdings Inc. announced Tuesday it is partnering with prepaid card platform provider Blackhawk Network Holdings Inc. to allow consumers to purchase digital gift cards on Affirm.com or in the Affirm app.

The deal builds on Blackhawk’s 2022 partnership with Klarna AB to let consumers use Klarna’s interest-free payment offering at physical retail locations.

With sales of digital gift cards growing more than twice as fast as physical gift cards, the total gift card market in the United States is expected to reach $260 billion over the next three years, according to Blackhawk.

The deal between the two companies is expected to give consumers more flexibility when it comes to financing gift purchases, especially during the holiday shopping season, as Affirm will offer BNPL loans for as low as 0% interest, according to both companies.

Gift cards are likely to be a popular gift this holiday season, as a recent Affirm study reveals that 70% of Americans plan to purchase a gift card. Consumers buying gift cards through the Affirm platform will be shown the total cost of their purchase and will not be charged late or hidden fees, Affirm says.

“We believe that people should not be penalized for being late, whether on their payments or shopping for any last-minute gifts,” Becca Stone, Affirm’s vice president of strategic partnerships says in a statement. “We are thrilled to partner with [Blackhawk], as we tap into a new segment and expand the reach of our network.”

BNPL providers have been steadily expanding the utility of the payment option by enabling consumers to finance a variety of purchases ranging from auto parts to travel, groceries and even cannabis. In the United States, BNPL provider Sezzle is making the financing option available through cannabis dispensaries in the United States, according to the company’s Web site.

Blackhawk says it has 37,000 partners and 400,000 channel touchpoints globally in its network and is used by more than 300 million shoppers daily worldwide.

In related news, BNPL provider Splitit Payments Ltd. has voluntarily delisted from the Australian Securities Exchange upon its closing on the first round of a $50-million funding from private-equity firm Motive Partners. Splitit is receiving $25 million during the initial round, which closed Monday. Splitit will receive the balance of Motive’s investment upon achieving certain 2023 full-year financial-performance milestones, which the BNPL provider says it is currently exceeding, and the satisfaction of certain other closing conditions.

“Motive’s investment significantly strengthens our balance sheet and brings additional global payments expertise, allowing the team to accelerate our white-label product strategy, product innovation, and our Tier One global distribution partnerships,” Nandan Sheth, managing director and chief executive of Splitit, says in a statement.