The buy now, pay later trend, which soared into prominence as a consumer-payments option during the Covid pandemic, continues to gain momentum. Certegy Payment Solutions LLC on Monday said it is working with a Tempe, Ariz.-based Ionia and its rewards platform to offer a BNPL service leveraging Certegy’s risk-management technology. Simultaneously, BNPL giant Klarna Bank AB launched Klarna Spotlight, a search engine allowing consumers to suss out the most favorable prices for products they’re trying to buy.

Clearwater, Fla.-based Certegy, which says it maintains a BNPL merchant network connecting to more than 65,000 physical stores and 75 online sellers, is adding Ionia’s Pay Later financing technology, which is offered through a rewards app called CrayPay. The partners say mobile apps offered by other Ionia partners will be added “soon.”

The partners are billing the merchant base as the largest such BNPL network in the United States, arriving at a critical time in the shopping calendar.

“As the holiday season kicks off, this is a critical time for customers to have digital payment access and flexibility. Through our partnership with Ionia, tens of thousands of merchants can now seamlessly bring the advantages of BNPL, including convenient, interest free payment plans, to their customers,” says Greg Lipari, vice president for strategy and commercial development at Certegy, in a statement. Certegy is a long-time transaction processor, best-known for its services in handling automated clearing house payments for merchants.

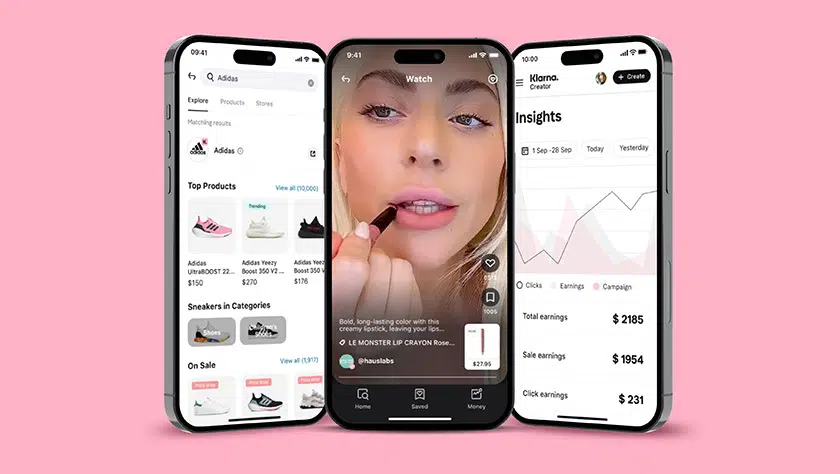

Meanwhile, Klarna, which has a significant stake of its own in the U.S. BNPL market, says it is enhancing its stake with the introduction of a search tool called Klarna Spotlight. The tool, available in the Klarna app as well as on the company’s Web site, compares prices across merchants and allows shoppers to search by such criteria as color, size, features, customer ratings, availability, and shipping choices. The company says its app, launched nearly a year ago, has attracted more than 23 million monthly active users. The Sweden-based company said in February its BNPL service had attracted more than 100 million active users globally and was available at some 250,000 retail companies.

Buy now, pay later capability allows shoppers to pay off purchases over time—typically in installments over a period measured in weeks—without interest.