In the latest buy now, pay later updates, Klarna AB introduced Virtual Shopping, an online service that connects shoppers with in-store experts, and Splitit Payments Ltd. joined the Visa Ready for BNPL program.

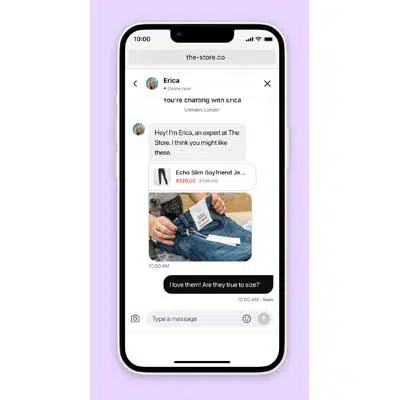

Stockholm-based Klarna says its Virtual Shopping service enables consumers to browse and buy online while connecting via live chats and video calls to in-store sales staff for help with relevant questions. More than 300 brands already use the service, which includes a new merchant-facing Klarna app that enables staff to share photos and videos with shoppers and demonstrate products live.

Virtual Shopping can help bridge the online and in-store shopping gap, Klarna says. In its latest Shopping Pulse Report, Klarna says consumers favor shopping in-store because of the social interaction and level of customer service offered.

“Unlike shopping in-store, the online experience does not allow consumers to see a product up close, touch, or try on items, making it hard to tell if products are true to size, fit, or color,” Klarna says. “Consumers today are looking for the same level of assistance when shopping online, with over three-quarters (78%) of U.S. shoppers believing that online retailers need to invest in new technology to create more personalized services (45%) and product recommendations (40%).”

Virtual Shopping is a step toward meeting these demands, says David Sandström, Klarna’s chief marketing officer. “In the past, online shopping has been missing a key element: human interaction,” Sandström says in a statement. “With Virtual Shopping, we replicate the brick-and-mortar experience of receiving personalized advice from an in-store expert and bring it to the online realm.”

In related news, New York City-based Splitit joined the Visa Ready for BNPL program, which is a vertical within the overall Visa Ready Program. The Visa Ready program provides certification guidelines and access to Visa products and marketing expertise.