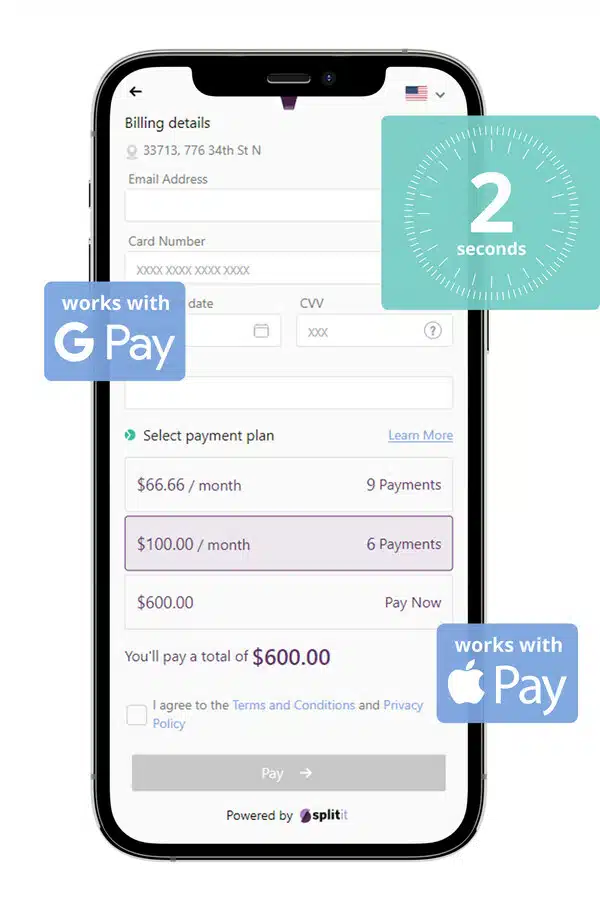

White-label buy now, pay later provider Splitit Payments Ltd., introduced on Tuesday SplititExpress, a checkout experience that enables consumers to complete checkout in less than two seconds, compared to one-to-two minutes for other BNPL applications, Splitit says. The new feature also supports installment payments via Google Pay and Apple Pay.

In addition, merchants can add their own branding and messaging at checkout, as well as choose the monthly or bi-weekly payment options best suited to their customers. Enabling this level of customization is expected to be a major selling point for merchants, especially those looking to enhance checkout, Splitit says. The new feature can be embedded in a merchant’s checkout with the addition of a few lines of code.

“Splitit’s unique solution utilizing available credit on payment cards in the checkout enables us to build a super-fast, frictionless experience that drives the highest conversion, with approval rates of over 85%,” Splitit Chief Technology Officer Ran Landau says is a statement.

Splitit’s BNPL app allows consumers to use their existing credit cards to make interest-free installment loans for purchases. Any consumer with available credit on their credit card is automatically pre-qualified to use Splitit for the value of that available credit.

In related news, Klarna AB has unveiled a suite of new features for its BNPL offering. Enhancements include a shopping feed in the Klarna app that delivers personalized product recommendations, as well as a personal shopper service called “Ask Klarna” to help consumers find products. New tools are also available for merchants to increase customer engagement.

The shopping feed, which uses artificial intelligence to learn about consumer preferences and is updated in real time, complements Klarna’s recently launched search-and-compare tool that lets consumers find the right product at the best price.

The shopping feeds build on Klarna’s initiative to use ChatGPT, the artificial intelligence-based chatbot developed by OpenAI, to provide personalized and intuitive shopping experiences.

“Our new AI-powered discovery shopping feed is the next evolution of the Klarna app becoming the starting point for every purchase,” Klarna chief executive and co-founder Sebastian Siemiatkowski says in a statement. “This builds on a ton of initiatives we’re working on in the AI space, to provide a greater level of personalization to consumers that was once thought impossible.”

Ask Klarna is a free service that provides consumers with on-demand access to shopping experts, via chat or video within the Klarna app and on Klarna.com. Klarna’s team of shopping experts help consumers find luxury products across thousands of brands and stores. Klarna plans to expand the service to more product categories.

Klarna’s new reselling feature within its app speeds up the process of creating listings on secondhand marketplaces by pre-filling product details and images. To resell a past Klarna purchase, a consumer taps on the resell button next to an item from her order history and is taken to a participating commerce platform. The feature is currently available in Sweden through Tradera, the largest resell platform in the Nordic region. Klarna plans to roll out the feature with other partners in other regions.

New merchant tools include Ads Manager, which harnesses Klarna’s first-party data to enable merchants to reach shoppers with highly customized messages and provide more relevant shopping experiences. Another new merchant tool is Creator Shops, which gives merchants the ability to launch their own storefronts on Klarna.com. Merchants can use Klarna’s recently launched Creator Platform to recommend products, share video and photo content, and share their storefront across social channels.