Prepaid card processors paired up with partners ranging from Facebook to Western Union to the MoneyPass surcharge-free ATM network in deals this week that expand the processors' distribution channels and transaction sources. In a cutting-edge deal that further opens up an Internet parallel to gift card giving, grocery chain Safeway Inc.'s Blackhawk Network announced a pact with Facebook, the huge online social network, under which Blackhawk's technology will enable Facebook members to buy and send content from Apple Inc.'s iTunes massive music and digital content service. The iTunes Online Gifts are available on Facebook's iTunes Fans Page. Senders can pick virtual gifts with themed designs for $5 to $50. Senders add a personal message, schedule a time to deliver it, and then pay with a Visa, MasterCard, or American Express card. Recipients see the gift as a post to their so-called Facebook Wall and can instantly redeem it at the iTunes Store. Only the intended recipient has the code to make a redemption. “Our culture of innovation allows us to explore and execute several options in the way consumers prefer to send and receive gifts,” Talbott Roche, senior vice president at Pleasanton, Calif.-based Blackhawk Network, said in a statement. “With iTunes we have expanded further in the online marketplace to reach consumers via social networks like Facebook.” Tim Sloane, director of the Prepaid Advisory Service at Maynard, Mass.-based Mercator Advisory Group Inc., says the Blackhawk-Facebook deal is “pretty cool. Blackhawk went right to the consumer with Facebook.” Facebook members, of course, won't know they're using Blackhawk's network, but the pact expands Blackhawk's distribution beyond the now ubiquitous gift card malls in grocery stores, pharmacies, and other physical retail locations, he notes. In another deal, wire-transfer giant The Western Union Co. and prepaid card marketer, distributor, and processor InComm are offering Western Union's new GoCash prepaid service. GoCash enables consumers to pay for prepaid domestic and international wire-transfers in denominations of $50, $100, and $200 at retail locations served by InComm. The purchaser then needs to call Western Union's customer-service line to actually make the transfer. “As prepaid products gain momentum with consumers, particularly in today's economy, Western Union sees the GoCash service as an opportunity to strengthen both its relationship and value proposition with consumers seeking convenient prepaid services, and mass-market retailers preferring to efficiently manage prepaid services at the check-out counter,” Stewart A. Stockdale, executive vice president and president, The Americas, for Englewood, Colo.-based Western Union, said in a news release. Atlanta-based InComm has 150,000 retail locations, though it was not immediately clear how many would offer GoCash. A spokesperson for Western Union could not be reached late Thursday. The Western Union-InComm deal enhances the prepaid product lineup, according to Sloane. “It's a significant new category added to the prepaid mall?a money-transfer category,” he says. And a third major prepaid card distributor and reload network, Monrovia, Calif.-based Green Dot Corp., was involved in a major deal this week. Minneapolis-based U.S. Bancorp said its MoneyPass surcharge-free ATM network would accept Green Dot's reloadable Visa and MasterCard prepaid cards. MoneyPass has 17,000 ATMs in its network. Green Dot's cards are sold in 50,000 retail locations, including CVS/pharmacy, Kmart, Kroger, Rite Aid, 7-Eleven, and Walgreen stores. Besides adding utility to Green Dot's cards, the deal also shows “MoneyPass remains in the game” as the surcharge-free ATM networks compete for new transaction sources, Sloane says. Cardtronics Inc.'s Allpoint is the nation's largest surcharge-free network, with 37,000 ATMs.

Check Also

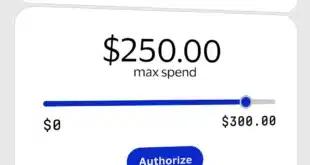

AI Commerce Gets a Boost From Visa, PayPal, and Mastercard

Visa Inc. late Wednesday introduced Visa Intelligent Commerce, an artificial intelligence-based shopping service that enables …