Galileo Financial Technologies LLC has expanded its buy now, pay later offering to small businesses for business-to-business purchases. The offering is available to lenders and fintechs using Galileo’s technology. They will have the option to customize the total number of installment payments for BNPL loans, according to Galileo.

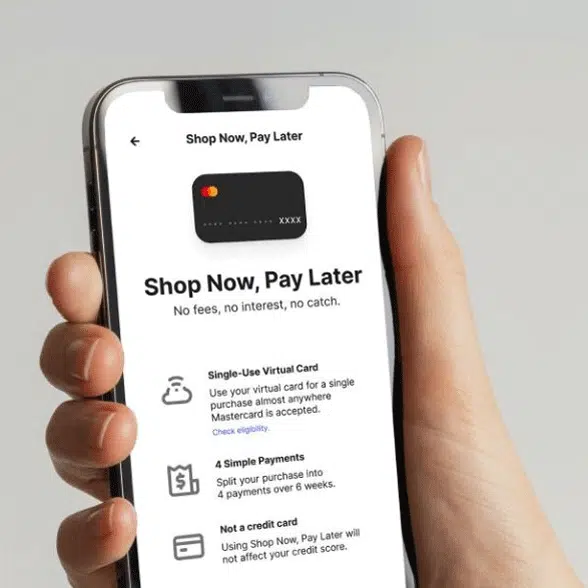

Galileo, which launched a BNPL program for consumers in December, expanded its BNPL offering to B2B purchases as a way to help small businesses gain easier access to capital and help them better manage the funding of purchases, the company says. Small businesses can access a Galileo BNPL loan through a virtual card for such purchases as capital improvements, repairs, or more inventory.

With the new service, lenders and fintechs can reportedly oversee the repayment schedule, disbursement of funds to the virtual cards running on the Mastercard Installments program, assessment of interest and fees, payment processing, chargeoffs, and optional credit reporting. Mastercard Installments, which launched in 2021, supports a zero-percent interest and pay-in-four BNPL model.

Mastercard research found that keeping up with rising costs is the top concern of small-business owners as they adapt to new realities. More than eight in 10 owners said they are looking for faster and easier access to capital, the research indicated.

“Following our successful launch of Galileo Buy Now, Pay Later, which provides fintechs and financial institutions with a solution to offer their consumers flexible payment options, Galileo recognized the growing need to provide the same level of choice and transparency for B2B lenders whose small-business customers need better access to credit,” David Feuer, chief product officer for Galileo, says in a statement. “Leveraging the power of the Mastercard Installments program, we extended our platform to give small-business owners the opportunity to do more with their money through increased access to funds.”