The pressure at Goldman Sachs Group Inc. to exit, or at least radically modify, its consumer-credit and payments businesses appears to be mounting. At least some executives at the company are pushing senior management to exit credit card deals with Apple Inc. and General Motors Corp., The Wall Street Journal reported Monday, citing sources familiar with the matter.

The movement to unload these businesses has apparently only increased in recent months among Goldman managers, with at least some senior executives having become disenchanted with the company’s consumer credit strategy, according to the Journal.

The rising sentiment within Goldman to sell the consumer card businesses, in particular, follows by days its sale of GreenSky, a consumer-lending firm it had acquired only in 2021. The move also builds on recent actions the Wall Street giant has reportedly taken to negotiate a withdrawal from supporting Apple’s credit card and iPhone maker’s buy now, pay later service.

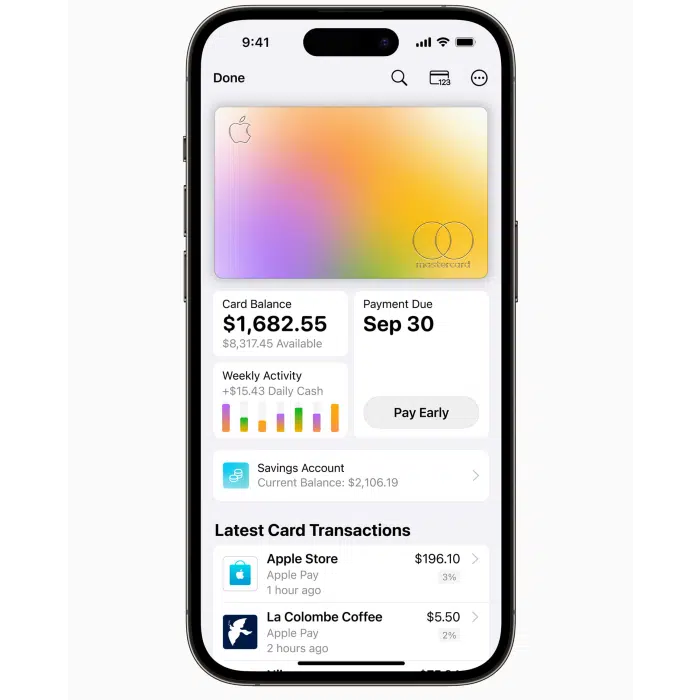

The actions to withdraw from the consumer credit card business are apparently driven by Goldman’s lack of familiarity with consumer credit, coupled with a high credit-risk burden, observers say. Apple launched its credit card in 2019, while Goldman began supporting GM’s cobranded card program only in early 2022, taking over from Capital One Financial. Spokespersons at Apple and Goldman did not immediately respond to a request for comment.

The pressure on Goldman to unload the credit cards is building in large part because of that inexperience with consumer lending, observers say. “Goldman Sachs does many things right, particularly as an investment bank, but was off the mark when it entered the rough-and-tumble world of consumer credit,” says Brian Riley, co-head of payments at Javelin Strategy & Research, in an email message early Monday to Digital Transactions News.

But now Goldman faces more problems, and of a different nature. “The card business will be more complicated to exit” than other consumer-lending forays, he says. Goldman “seemed to have oversimplified the nuances of building a healthy loan book,” Riley adds. “Competing with established players in the credit card business for decades takes more than just the ability to lend.”

And there are more reasons unloading the business will be tricky for Goldman, Riley argues. “The issue they face today is how they unfold their credit card business. It will likely be at least as costly as it was to exit GreenSky,” he says. Goldman paid $2.2 billion for the lender, selling it only months later at a loss.

Also, market conditions would also likely complicate a sale, should Goldman determine to go in that direction. “In contrast to a BNPL [player], where lending is on short-term contracts, a card business must reserve large blocks of cash to meet its credit line commitments, and the payback is measured in years, not months,” he says. “Also, the buyer would likely need to be an established credit card lender, and in today’s world, the market is focused on liquidity and the unsteady environment.”