Half of online banking customers now receive fraudulent e-mails, known as phishes, and 78% say they are less inclined to respond to e-mails from the banks they do business with. That's according to a study released by New York-based security software company Cyota Inc. that illustrates how much worse the phishing trend?and the toll it's taking on consumer trust in Internet channels?is getting. In a survey the firm conducted last November that garnered 655 responses representative of the U.S. adult population with Internet access and a bank account, 50% of consumers say they have received a fraudulent e-mail attempting to steal account data or passwords by directing them to bogus Web sites. That's twice the number that reported having been phished in an April survey. Of this number, 5% say they gave up personal data, a potentially lucrative response rate for fraudsters. Just over half reported the fraud to the targeted bank. The survey also points up the growing vulnerability of online passwords. Forty-four percent of respondents say they use the same password for multiple online banking sites, rendering all of those sites accessible to criminals if they succeed in gulling the passwords out of the account holders. Only one-third say they have a different password for each site. Meanwhile, some 37% report they also use their online banking passwords at less secure sites. Indicating the extent to which phishing is eroding consumer trust in the Internet as a transaction channel, more than three-quarters of respondents say they are somewhat or very much less likely to trust e-mails coming from their banks. Half say they are somewhat or very much less likely to continue using online banking services or to sign up for new ones.

Check Also

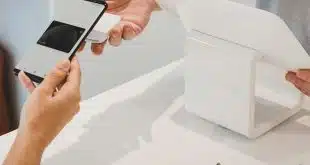

How Tap-to-Pay Has Evolved—And What Comes Next

Ever since the card industry launched technology that lets merchants process transactions through an off-the-shelf …