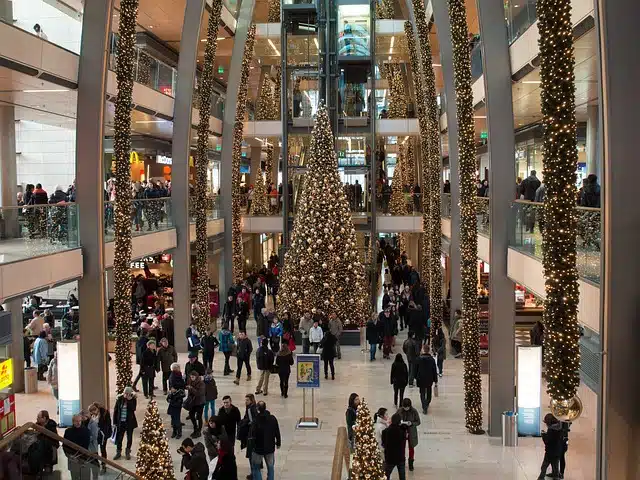

Holiday sales were robust in November, giving merchants reason to be optimistic about overall spending for the holiday shopping season, according to the National Retail Federation.

Total retail sales in November, excluding automobiles and gasoline, rose 0.77% month-over-month on a seasonally adjusted basis, and 4.24% on an unadjusted basis year-over-year, according to the CNBC/NRF Retail Monitor. In October, month-over-month retail sales decreased 0.08% on a seasonally adjusted basis, while increasing 2.57% on an unadjusted year-over-year basis.

The CNBC/NRF Retail Monitor, which launched last month, tracks credit and debit card purchase data on a monthly basis by Affinity Solutions Inc., a provider of consumer purchase data and insight solutions, for nine core retail sectors. The retail sectors tracked are online and other non-store sales, health and personal care, sporting goods, hobby, music and books, clothing and accessories, grocery and beverages, electronics and appliances, general merchandise, building and garden supplies, and furniture and home furnishings.

“Sales for November were stronger than expected given the weakness we saw in the prior month,” says Mark Mathews, executive director of research for the NRF. “Survey data we gathered over Thanksgiving and Black Friday told us to expect strong growth that weekend.”

Another factor in the stronger-than-anticipated year-over-year growth is that the Retail Monitor does not adjust year-over-year data for inflation. “We are seeing zero-percent inflation, and in some categories negative inflation, which makes year-over-year growth harder [to achieve],” Mathews adds. “Overall, what we are seeing is a return to normal growth prepandemic.”

Sales in Retail Monitor’s nine core categories, excluding restaurants, automobiles, and gas, increased 0.73% month-over-month on a seasonally adjusted basis and 4.17% year-over-year on an unadjusted basis in November. In October, core sales decreased 0.03% month over month seasonally adjusted while increasing 2.63% unadjusted on a year-over-year basis.

Categories showing the strongest gains were online and other non-store sales, which grew 0.8% month-over-month on a seasonally adjusted basis and 26.2% on a year-over-year unadjusted basis; health and personal care, which was up 1.6% month-over-month seasonally adjusted and up 9.15% year over year unadjusted; and sporting goods, hobby, music and books, which increased 1% month-over-month seasonally adjusted and 8.25% year-over-year unadjusted.

“November Retail Monitor data shows that consumers are embracing the holiday season and promotions being offered by retailers,” NRF president and chief executive Matthew Shay says in a statement. “Value-conscious shoppers are out looking for deals as they purchase gifts for family and friends, and this data indicates that they’re finding them. Since November makes up half the holiday season, these numbers are a positive indication of what we can expect for the full holiday season.”