Television streaming service Hulu LLC says it now accepts PayPal Holdings Inc.’s Venmo peer-to-peer payment service. Hulu could be a major win in PayPal’s ongoing effort to increase the popular Venmo’s profitability because the service will generate a recurring revenue stream.

Founded in 2007, Santa Monica, Calif.-based Hulu competes with the likes of Netflix and Amazon. The company provides instant access to live and on-demand channels, original series and films, and a library of TV shows and movies. Hulu announced in May that it had more than 20 million U.S. subscribers.

“We constantly strive to make it easy for you to stream, any way you want,” Hulu said in a Thursday blog post. “And that includes how you want to pay for your Hulu subscription. That’s why we’ve partnered with Venmo, the app you love to use to send money, to bring you a new way to pay for your Hulu subscription. We’re very excited about this partnership because Hulu is the first-ever TV streaming service to offer Venmo as a payment option for your subscription.”

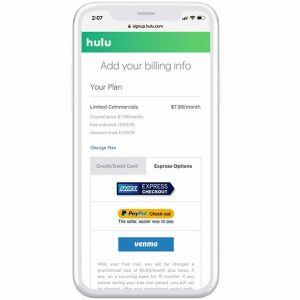

New subscribers can use their mobile Web browsers to choose Venmo as the payment method for monthly subscriptions. From there, the customer’s Venmo balance or linked payment method will be billed. Current subscribers will get the Venmo option soon, Hulu said.

A spokesperson for San Jose, Calif.-based PayPal, which also is a billing option on Hulu, did not respond to a Digital Transactions News request for comment. PayPal has been working steadily to add merchant acceptors for Venmo because, unlike consumers using it for P2P payments, they’ll pay for the service. Recently, however, Venmo has struggled will a spike in fraud.

Access to new recurring revenues is good news, but Venmo likely will encounter some new operational issues, according to e-commerce payments analyst Jordan McKee, a research director at New York City-based 451 Research.

“Venmo’s deal with Hulu signals its growing appetite to become a C2B [consumer-to-business] payment method across a variety of merchant verticals,” McKee tells Digital Transactions News by email. “Recurring revenues are certainly an appealing aspect of this deal, but Venmo must be prepared operationally to handle the influx of customer-service inquiries that will come with it.”

Inevitably, McKee notes, some customers will forget they signed up for Venmo billing but notice that funds are missing from their Venmo balance. “This is new territory for Venmo and it must have the support infrastructure in place to address more inbound customer-service requests,” he says.

What’s more, PayPal should limit its expectations for customer adoption of Venmo for C2B payments if an autumn survey of 3,104 consumers by 451 Research is any indicator. “Just 3.4% of respondents said they would be very likely to use a P2P payment app to make purchases from a business or store if it were offered as a payment option,” McKee says. “Another 15.1% said they would be somewhat likely.”