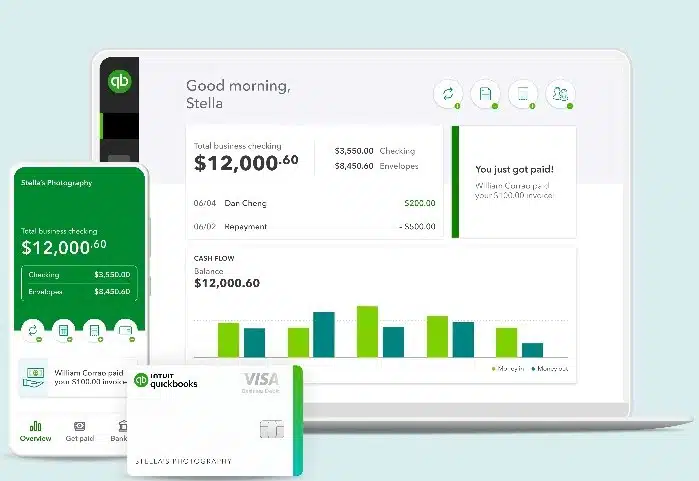

Intuit Inc., developer of the QuickBooks accounting software and related services for small businesses, embedded itself further into the payments business on Wednesday when it unveiled QuickBooks Money. The free product allows businesses to send invoices accepting payment choices including credit, debit, automated clearing house, PayPal, Venmo, and Apple Pay or Google Pay, in addition to offering banking services.

The new service is an expansion of Money by QuickBooks, introduced in 2021 as a mobile app for iOS and Android devices, and includes the existing products QuickBooks Payments and QuickBooks Checking, according to Mountain View, Calif.-based Intuit.

Among other new features, QuickBooks Money can be accessed through the Web and has additional invoicing and banking capabilities, Intuit says. Importantly, users do not have to subscribe to QuickBooks services, though eventually gaining new subscribers is clearly Intuit’s intent.

“QuickBooks Money brings Intuit’s expertise in financial services to an even wider audience of small-business owners who may not initially need the QuickBooks platform’s full range of financial-management and accounting capabilities but are still seeking one simple tool to get paid and manage their money end-to-end,” Intuit said in a news release. “As these businesses grow and require additional tools to help manage their business, they’ll have a seamless path to access the full range of solutions the QuickBooks platform offers such as accounting, payroll, workforce management, and more.”

David Talach, senior vice president of the QuickBooks Money Platform at Intuit, added in a statement that “QuickBooks Money represents an incredible opportunity to expand the reach of our fintech platform and give more small businesses access to powerful cash-flow management tools. We believe this is a true front door to the future of small-business success.”

Approved account holders can get some payments deposited into their bank accounts on the same day, including weekends and holidays.

The launch of QuickBooks Money comes fully 20 years after Intuit delved into the payment card acceptance business with its acquisition of the California-based independent sales organization Innovative Merchant Solutions for $116 million. Intuit says QuickBooks Payments now processes more than $125 billion in volume annually.

Excluding ACH payments, Omaha, Neb.-based merchant-acquiring consulting firm TSG (formerly The Strawhecker Group) estimates Intuit processed just shy of $58 billion in card-based volume in 2022, making it the 22nd-largest U.S. acquirer, and served 966,000 merchants.

Next month, Intuit is expected to discontinue its QuickBooks POS service, an outdated system superseded by other Intuit services over the years.

Intuit says future planned enhancements to QuickBooks Money include subscription-free access to other QuickBooks services such as bill pay, in-person payments, and lending. QuickBooks Money customers at any time can upgrade to the QuickBooks array of subscription-based products such as accounting, payroll, and other services. Intuit’s banking services, including checking accounts, are provided by Green Dot Bank.

In August, payments giant PayPal Holdings Inc. appointed long-time Intuit executive Alex Chriss to succeed Dan Schulman as chief executive. Schulman is retiring. Chriss was expected to take over this month.