InvoiceASAP Inc., a provider of invoicing and payment technology for small and medium-size businesses, has partnered with Adyen NV to provide merchants instant access to deposited funds.

InvoiceASAP will leverage Adyen for Platforms, an end-to-end payments and customer-experience platform, to offer its 23,000 merchants immediate access to pending funds and bank deposits, using the FedNow real-time payments network.

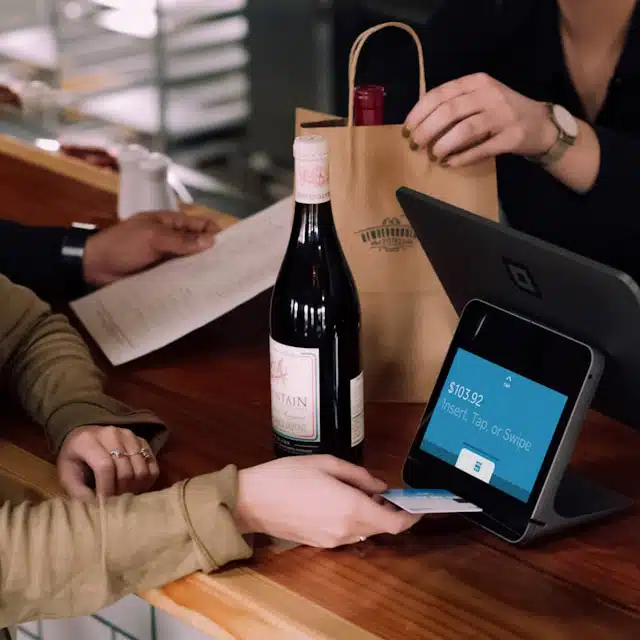

InvoiceASAP merchants are primarily field-service businesses, such as tradesmen and delivery services. Many of these merchants need immediate access to deposited funds and capital to run and grow their businesses, according to Adyen.

Prior to the deal, InvoiceASAP used Adyen’s CashOut app to provide immediate access to pending funds.

“By using real-time payment rails, the merchant can receive funds the moment the customer agrees to pay, instead of waiting for ACH,” notes Thad Peterson, a strategic advisor for Datos Insights. “This can be critical for merchants with limited cash resources.”

An early adopter of FedNow, Adyen is actively leveraging that certification to enhance its appeal to fintech providers such as InvoiceASAP by enabling their access to a real-time payment network, the company says.

FedNow, which launched in July 2023, has signed about 900 financial institutions. Meanwhile, The Clearing House Payments Co. LLC’s RTP network, which launched in 2017, had 668 banks and credit unions as of the end of the second quarter, a 96% year-over-year increase.

Part of FedNow’s appeal is that it can be enabled by organizations that aren’t financial institutions by working through participating institutions, Peterson says.

“Further, smaller FIs appear to be selecting FedNow over RTP, possibly because RTP/The ClearingHouse is owned by the largest U.S. banks,” Peterson adds.

While FedNow may have an advantage in the number of financial institutions, many of which also use the RTP network, one advantage The RTP network has over FedNow is that it reaches more demand-deposit accounts, Eric Grover, proprietor of payments consultancy Intrepid Ventures, says by email.

As of July, RTP reached 68% of demand-deposit accounts in the United States, according to TCH.