- Merchant processor iPayment Inc. has agreed to acquire Leaders Merchant Services, an independent sales organization that has worked with iPayment since 2004. Terms were not disclosed.

- Electronics maker SparkFun Electronics developed an app for Android devices that can detect the likely presence of a credit card skimmer commonly found on gas pumps.

- First Data Corp. said it has agreed to process in-store, online, and mobile transactions globally for AccorHotels, which operates more than 4,200 hotels, resorts, and residences, as well as managing accommodation at 10,000 private residences.

- Ingenico Group said spending growth across the European Union on Black Friday, the day after Thanksgiving, is on track to outpace growth in the United States that day. It forecasts that EU Black Friday sales growth will be 450% above an average Friday compared with 162% increase it predicts for the United States.

- Holiday-season sales will be strongest in the Northeastern United States and weakest in the Southwest, according to a report from The Strawhecker Group and the Electronic Transactions Association. In the Northeast, same-store sales on payment cards in November and December will be up 6.4% and 5.3%, respectively, compared to the same months in 2016, according to Strawhecker projections. By contrast, the changes in the Southwest will be -0.3% and 0.4%.

- Payment technology provider ACI Worldwide Inc. says its analysis of transaction data from leading merchants shows merchants can expect a 30% year-over-year increase in fraud attempts this holiday season, with identity theft, account takeovers, and friendly fraud through chargebacks posing some of the biggest problems.

- Results of a survey of Canadian consumers commissioned by PayPal Holdings Inc. predict that Canadians will spend more than C$2.5 billion ($1.97 billion) buying holiday gifts this year from mobile devices.

- Richard Cordray, the outgoing director of the Consumer Financial Protection Bureau, sent a letter to CEOs of banks, credit unions, and other financial companies encouraging them to give consumers more control over payment methods.

- Distributed-ledger specialist Ripple, which manages the XRP digital currency, added Benjamin Lawsky to its board of directors and appointed former investment banker Ron Will as chief financial officer. Formerly superintendent of financial services for the state of New York, Lawsky was the first state official to introduce digital-currency regulation.

- Payments-consulting firm Mercator Advisory Group released the “2017 ATM Market Benchmark Report.“

- A study of retail banking from Bain & Co. found that PayPal Holdings Inc. and Amazon.com Inc. rank nearly as high as banks for trust for consumer funds among U.S. and U.K. consumers.

- JetPay Corp. announced Robert Metzger, an executive at William Blair & Co. and director of the Investment Banking Academy at the University of Illinois, has been appointed to its board of directors.

Check Also

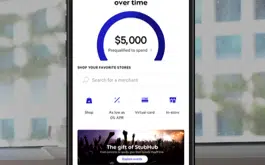

Affirm Expands Credit Reporting And Adds Adyen U.K. Clients

Installment-payments specialist Affirm Holdings Inc. will include all of its products in data sent to …