Financial technology provider Kasheesh Inc. on Thursday launched a virtual card that allows consumers to split payments for online purchases across up to five existing credit, debit, and prepaid cards. The card is intended to provide an alternative to buy now, pay later loans.

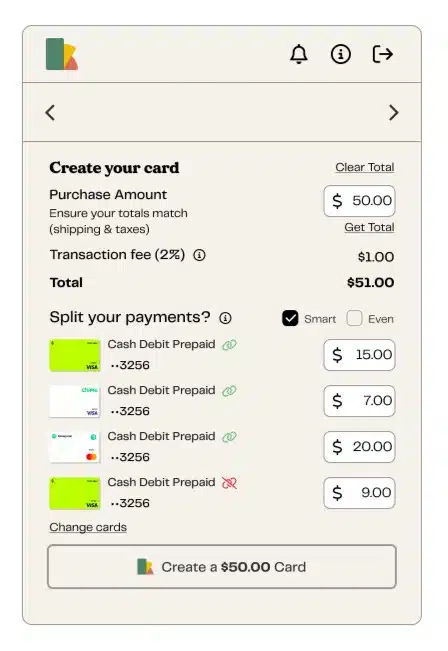

The Mastercard-branded card can be loaded into digital wallets, such as ApplePay and GooglePay, and allows consumers to determine which percentage of the purchase they want to designate for each card used, regardless of the brand.

The new card, which New York-based Kasheesh calls the Multi Use card, builds off the company’s single-use digital debit card that allows consumers to split a single purchase across multiple cards before it is deactivated.

Kasheesh developed its multi-use card in response to consumer demand for a reusable card that can be used for payments such as rent, electric bills, cell phone bills, and Amazon purchases, the company says.

“Rather than being limited with the options BNPL offers, Kasheesh provides true consumer flexibility without putting [consumers] in a position where they’re loan stacking or dealing with hidden predatory lending,” Kaseesh chief executive Sam Miller says by email. “Consumers get to use what’s already in their wallet rather than being underwritten by non-financial institutions for loans that tend to pile up.”

Consumer use cases for Kasheesh’s split-payment products include rent payments, Costco purchases, eBay purchases, health insurance bills, the list goes on, Miller says.

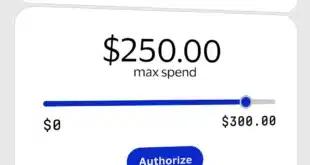

To create the multi-use card, consumers open the Kasheesh mobile app or log into their Kasheesh account on their computer. Once the card is created, it can be added to their digital wallet. When making a purchase, consumers designate what percentage of the purchase they want split among the cards they will use to pay for the purchase on the Kasheesh cards page.

“[With Kaseesh], consumers no longer have to track which loans were done with a BNPL provider to know when payments are due and they completely control the experience without relying on BNPL systems.” Miller adds.

Part of the appeal of splitting payments across multiple cards, advocates say, is that, unlike a BNPL loan, for which terms and conditions can vary by lender, consumers can choose which cards they want to use to pay for a purchase, for which they already knows the terms and conditions of repayment, to help them budget their finances.

“With Kasheesh, you can swap out which cards you want to use and when, allowing for consumers to budget in a more efficient manner between paychecks,” Miller says. “If a consumer knows their bill is due soon or they’re getting paid in a few days, it allows for optimal planning and spending completely personalized based on their needs.”

Experts see potential for the service. “Most consumers have at least one credit card and one debit card. To my knowledge, most online merchants do not enable this option. Therefore, I’d say this is a welcome option among consumers because it puts more purchasing flexibility in their wallet,” says Ariana-Michele Moore, advisor for retail banking and payments at Datos Insights, in an email message.