Looking to dispel criticism that buy now, pay later loans are predatory-lending products, BNPL provider Klarna AB has launched Wikipink, a Web page that details information about its BNPL business, such as repayment rates, late fee rates, and consumer demographics.

“By publishing our facts and figures with full transparency, including age demographics, repayment rates, and late fee rates, among others, we’ll demonstrate that interest-free BNPL leads to better consumer outcomes than traditional credit,” Klarna states on the page.

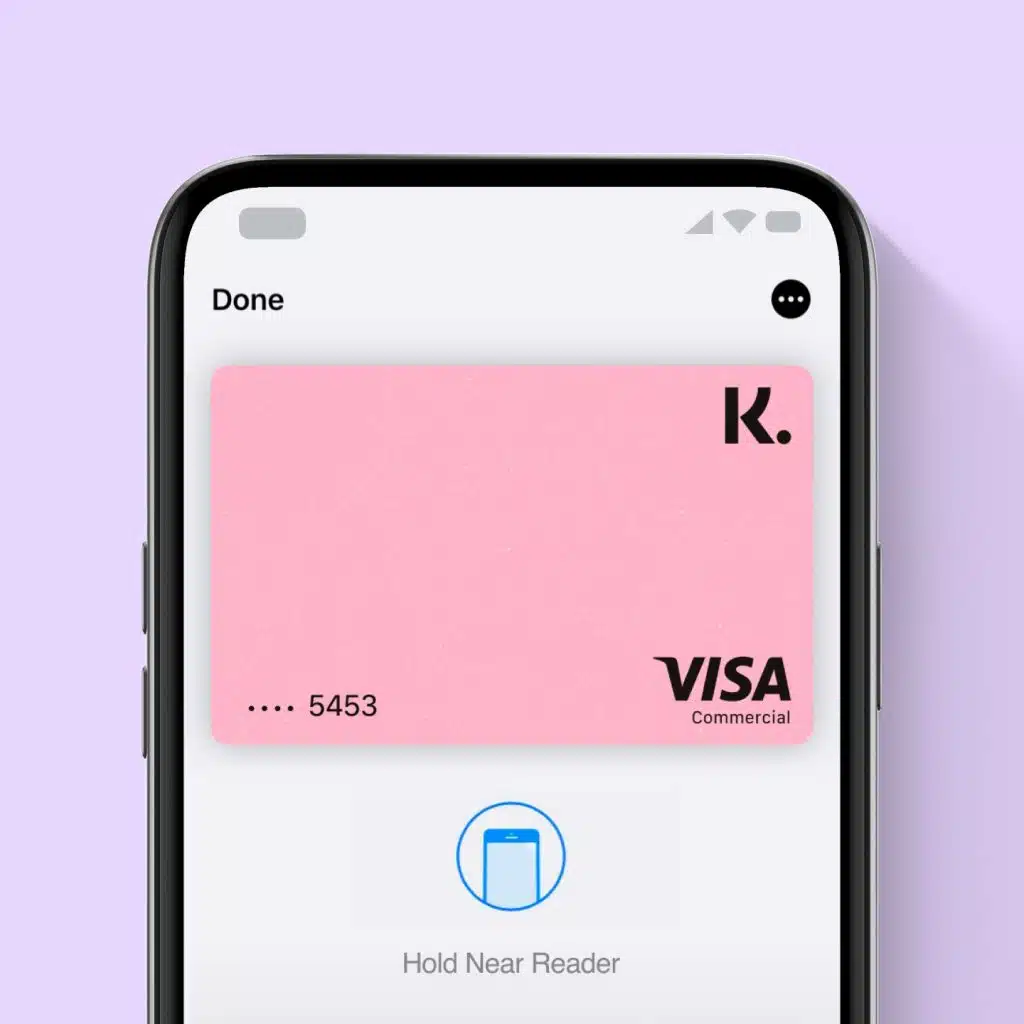

The name of the Web page plays off the color of Klarna’s logo, which is pink, and the concept of providing public information online through a wiki.

To drive home its point about BNPL, Klarna notes on the page that 31% of its Pay in 4 users in the United States paid their bills early, 65% paid on time, and only 4% incurred late fees in 2023, with overall late-fee rates showing a decline over time. In addition, Klarna says that its global default rate is less than 1% and that 99% of loans are repaid.

In comparison, a Klarna-commissioned Harris Poll of more than over 2,000 U.S. adults reveals that, on average, 41% of credit card users revolve a balance month-to-month, and that 23% of those users have been late paying their monthly bill and either incurred a late fee or had a credit card payment go into debt collection in the past year.

The proportion of consumers revolving credit card balances on a monthly basis is highest among Gen Zers and Gen Xers (47%), followed by Millennials (44%) ages Baby Boomers (33%).

In addition, 45% of households with an annual income of $75,000 to $99,000 and 31% of households with annual incomes of $100,000 or more also carry balances month-to-month.

The Harris Poll survey also reveals that 55% of credit card users say they do not know their credit cards’ annual percentage rate and 13% of credit card users admit they are not clear on all of the different payment amounts listed on their credit card bill and how they each accrue interest.

The data reflect the growing debit burden credit card users in the U.S. are shouldering, Klarna says. Credit card debt hit a record high of $1.13 trillion, according to a 2023 study by the Federal Reserve Bank of New York.

“We still see too many of the traditional banks and credit card companies pushing products on consumers with exorbitant interest rates, hidden fees, and revolving debt,” David Sykes, Klarna’s chief commercial officer says in a statement “It is very clear that the traditional credit card model does not work in the favor of the vast majority of customers.”

Sykes adds that Wikipink is not just a showcase of Klarna’s achievements, “but a call to action for the entire financial industry to prioritize consumer well-being. By sharing our data and practices openly, we aim to inspire a shift towards more ethical, transparent, and consumer-friendly credit options.”