With $2.28 billion in losses over the past three years, ride-share provider Lyft Inc. is looking to cut costs—and payment-card acceptance expenses won’t be spared.

San Francisco-based Lyft outlined several initiatives it already has started or is planning in a filing earlier this month with the Securities and Exchange Commission for an initial public offering of stock. The registration statement notes that as Lyft’s ride volume has grown, so have its payment-processing fees: up $109.6 million last year following a $140.3 million increase in 2017.

The so-called S-1 filling doesn’t say whether payment costs are rising in exact lockstep with ride volume. Payment fees are listed in a line item called cost of revenue that also includes insurance, where bills are rising even faster than payment fees, and hosting and platform-related technology expenses. In all, cost of revenue totaled $1.24 billion in 2018, up 89% from $659.5 million in 2017, when costs rose 136% from 2016. Higher costs in the three categories all “were driven by significant growth in the number of rides,” the filing says.

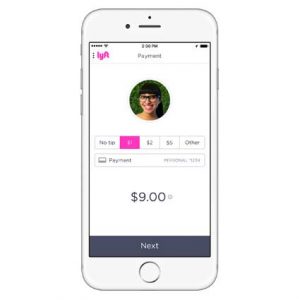

Lyft drivers have provided more than 1 billion rides since the service launched in 2012. Most rides are paid through credit and debit cards via Lyft’s mobile app, or through third-party payment services. The IPO filing outlines several ways in which Lyft is trying to rein in payment costs.

“In 2018, we added an additional payment processor for credit and debit card transactions,” the filing says. “We expect the fees paid to this additional payment processor will be lower than our other primary provider.” The filing names neither provider, but San Francisco-based e-commerce processor Stripe counts Lyft as one of its customers.

Lyft also said it is revising its transaction workflows to avoid incremental fees. “For example, we are updating our payment processing to capture a ride fare and tip as a single transaction rather than two separate transactions with two separate processing fees,” the filing says.

That effort echoes a plea a Lyft executive made at a Chicago conference last summer in which he called on the payment card networks to revise their procedures to accommodate new gig-economy companies such as Lyft.

“Lyft is a high-volume business with a lot of transactions; they appear to have reached the point where they can successfully lower their cost per transaction,” e-commerce researcher Thad Peterson, a senior analyst at Boston-based Aite Group LLC, tells Digital Transactions News by email. “Combining the fare with the tip will also consolidate their volume and increase the efficiency of their payment operation.”

Lyft also indicated it’s ready to bargain for lower interchange, and might even introduce its own payment-related services. “Over time we intend to lower costs of significant portions of our portfolio by negotiating private interchange rates with larger financial institutions and by possibly creating our own payment products,” the filing says. The document doesn’t offer details, and a Lyft spokesperson did not respond to a Digital Transactions News request for comment.

“As company revenue increases so too do their payment expenses, and as they achieve scale it’s logical to explore both lower-cost alternatives as well as additional feature functionality that adds value,” says Peterson.

Lyft reported 2018 revenues of $2.16 billion, more than double 2017’s $1.06 billion. Its loss, however, increased to $911.3 million compared with a loss of $688.3 million the year before. The date of the IPO has not been set.