Barrels of ink have been poured and hours of shows have been aired on the hot topic of payment anonymity. Much of it plays on consumers’ uneasiness about the fact that Visa and Mastercard have a perfect view into who you are, how you spend your time, and your circumstances.

A record of the things you pay for is an x-ray plate of your innermost self. And the networks have it, which means that, by force of the Patriot Act, the government has it.

It is this uneasiness that is responsible, in great part, for the rush to Bitcoin. People around the world who study cryptography in the Crypto Academy on YouTube are coming back time and again, eager to learn just the basics so they have a clue what this airy Bitcoin is, and how to take part in its celebration.

When I have a chance to talk to these people, I ask them three questions: Why do you wish to gamble on an asset that may drop to absolute zero tomorrow morning—with no recourse? Why do you wish to put your wealth at risk of having your private key hacked? And why do you wish to trade in a public square inundated with fraudsters, criminals, terrorists, and other shady characters? The answer they give: Bitcoin comes with the lure of payment anonymity, and given our data nakedness, we will cling to any fig leaf.

Really?! Would you wish to live in a society where all payments are private, all payers and payees remain anonymous, and wealth accumulation is publicly unaccounted for? All that may seem harmless, but think about it. Wealth is power. Money gets people to do things they don’t like, even things that are morally repulsive. “Everyone has his price,” says the old maxim.

Bribery, undue influence, buying “justice,” harassing the weak, crushing an opponent, grabbing political power, families unraveling—all this and more will flourish unchecked in a society where payment remains comprehensively obscured. Think about it for a minute and you will agree with me. Unconditional anonymity of payment is a death sentence for justice and freedom.

So, back to Bitcoin. Imagine that Bitcoin becomes the currency of the land, and further imagine that the Bitcoin premise of total anonymity holds. If this happens, its price versus the dollar will be meaningless, because Bitcoin will replace the dollar. As such, it will very quickly be distributed in the population in virtually the same distribution of wealth recorded by the dollar.

The currency is only the unit of wealth. Wealth distribution reflects human characteristics and social connections. These things don’t change when society switches currencies. But if Bitcoin is the currency, then who will pay taxes, since no income will be visible to the Internal Revenue Service? Who will stop the wealthy from abusing their wealth, virtually enslaving the poor?

Bitcoin, today, is propped up by traders who use it mainly because of its anonymity, which is essential for their shady business. All ransomware is payable by Bitcoin. For child pornography, illicit drugs, political influence, and industrial espionage, Bitcoin is the currency of choice. Traders include, I’m sorry to say, some very respectable governments that use Bitcoin for their under-the-rug operations.

The truth is that Bitcoin’s anonymity is overhyped. The exposure of all Bitcoin transactions allows the big boys with massive data-analytics tools to extract valuable information from the Bitcoin general ledger.

That’s why the bad guys move to secure their anonymity through account mixing, secret forking, and the silent theft of dormant accounts. Governments face a mounting challenge to wrestle away the benefits of anonymity claimed by the evil-doers.

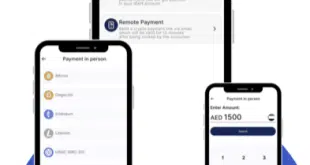

Anonymity is the necessary leverage for ill-gotten money. So, more and more money sinks into private, non-speculative currencies, where undercurrent payments are carried out with complete anonymity, popping out to trade against Bitcoin, like a submarine surfacing. We see all this in the strange places where interest is expressed in our BitMint platform.

The right way out is simple, both conceptually and technologically (though not politically): Digital-money protocols should mimic the Fourth Amendment of the U.S. Constitution. That is, privacy is afforded to law-abiding citizens, but a court warrant should unmask any trader. Fair warning: I once publicly proposed how Bitcoin could comply with this idea, but was kicked off the stage very quickly.

Gideon Samid • Gideon@BitMint.com