Even people in the payments industry are confusing the terms, and that’s obscuring some important developments in mobile acceptance, says Scott Holt.

The convergence of mobile payment and mobile-payment acceptance is interesting because it enables a true mobile-to-mobile transaction.

Scott Holt is vice president of Roam Data Inc., Boston, Mass.

Working in the mobile-payments space, I see a lot of confusion about the term “mobile-payment system.” This may be because so many vendors slap the phrase “mobile-payment system” on their products, hoping to increase their appeal. In some cases, the terms “mobile wallet” and “mobile-payment system” are used interchangeably, as if they meant the same thing.

In reality, this broad term “mobile-payment system” can encompass several different things, including open-loop mobile wallets (e.g., Google Wallet), closed-loop mobile wallets (e.g, Starbucks) used by consumers, and mobile-payment acceptance solutions used by merchants. Some vendors that talk about “mobile-payment systems” imply that merchants need all three of these things. The fact is, they need only one, the mobile-payment acceptance solution. But they should accommodate at least one of the others.

Dispelling Confusion

To help dispel the confusion over “mobile-payment systems,” here’s a quick breakdown:

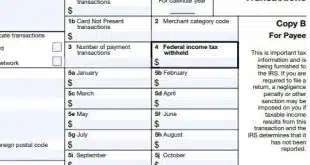

In every payment transaction, there are two sides, the payor (making the payment) and the payee (accepting the payment). Payors can use cash or debit/credit cards, of course, but if they choose to make a payment using their own mobile device they need either an open-loop mobile wallet or a closed-loop mobile wallet.

Examples of open-loop mobile wallets are Google Inc.’s Google Wallet, MasterCard Inc.’s MasterPass, and the recently departed Square Wallet from Square Inc. These applications store information from a consumer’s credit cards—typically multiple cards—and are designed to securely pay for individual transactions across multiple merchants, provided those merchants are equipped to accept mobile wallet payments.

Most open-loop mobile wallets use a barcode or quick-response (QR)-code model, though some rely on proprietary readers at registers or near-field communication (NFC) technology.

Closed-loop mobile wallets are merchant-specific. For instance, Starbucks offers a closed-loop mobile wallet, as do Dunkin Donuts and McDonald’s. These closed-loop wallets are often apps downloaded from the Apple or Android store, and thus many call them “mobile-payment apps.” Merchants like closed-loop mobile wallets because they can track purchases and data and add services such as a loyalty program and rewards tracking.

On the payee side, merchants typically have either fixed terminals or mobile point-of-sale (mPOS) solutions enabling consumers to pay via a merchant-owned mobile device, or both. The “both” option is gaining in popularity, but, much as some U.S. households are abandoning landlines in favor of mobile phones, many smaller merchants are going right to mPOS.

Early forms of mPOS solutions were narrow in scope and involved a dongle that plugged into a smart phone or tablet. The vendor usually acted as a payment service provider and processed transactions, deducting a fee for each one. There were no tie-ins with a merchant’s payment infrastructure or other backend software, such as inventory or loyalty programs.

Recently, more advanced mPOS solutions have emerged that not only process cards but also offer a host of other capabilities, including the ability to:

– Process additional payment types, including NFC, chip and signature, and chip and PIN;

– Accept open-wallet systems;

– Accept merchant-specific, closed-loop mobile wallets.

On the fixed POS side, merchants can leverage add-ons such as barcode scanners to accommodate closed-loop wallets, provided they produce a barcode or QR code, like the Dunkin Donuts closed-loop wallet does. But mPOS solutions provide a unique level of flexibility, and their software can be updated quickly and easily, allowing merchants to accept new forms of payment on the fly—not only their own closed-loop wallets, but open-loop wallets as well.

As a result, we’re seeing early-adopter merchants accepting both types of mobile wallets on their mPOS solutions. For example, we are currently working with one of the world’s largest fast-food chains on an out-of-store mPOS solution. This is an overlay to their existing in-store payment infrastructure that accepts open- and closed-loop mobile wallets plus different types of card transactions (magnetic stripe, NFC, chip and PIN and chip and signature). It’s completely future-proof. But this isn’t typical. Most merchants today are simply interested in closed-loop wallets and debit/credit card acceptance.

Closed to Open-Loop

Indeed, our experience to date has been that most merchants are far more interested in closed-loop mobile wallets than open-loop. This is because of the ancillary benefits that come with these closed systems, primarily purchase/data tracking and loyalty programs. In fact, very few merchants inquire about open-loop mobile-wallet acceptance.

Many have been hesitant to adopt this type of wallet because they want ownership over their entire merchant/consumer experience. They also want to maintain control over how their customer information is collected and used. They don’t want to enable that information to potentially be shared with competitors.

The convergence of mobile payment and mobile-payment acceptance is interesting because it enables a true mobile-to-mobile transaction. The consumer pays with a mobile device and the merchant accepts payment with one. This scenario frees both payor and payee from being tied to one location and enables much more flexible, yet secure, payment options, including kiosks, delivery, pop-up stores, and the like, on top of existing payment infrastructure.

It also enables the 55% of merchants currently not accepting credit cards at all to do so without having to invest much in infrastructure. This is where we see the industry headed, and mPOS solutions—not just wallets or “mobile-payment systems”—will play a key role in making that happen.