This young demographic is shaking up payments. Capturing their business requires new tools, new approaches, and, above all, open-mindedness.

My 80-year-old mother doesn’t have an ATM card, but I don’t think my 4-year-old grandson will ever have a checkbook.

Hard cash’s days are numbered. The payments industry is in the midst of a seismic shift, and Millennials—those born approximately between the mid-1980s and 2004—are leading the charge, accounting for 55% of all mobile payments.

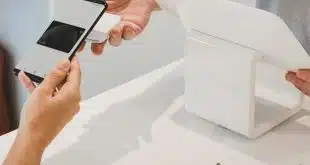

What it boils down to is that Millennials use financial technology very differently from older generations, embracing alternative payments such as Apple Pay and Google Wallet and socially integrated applications like Venmo, Facebook Messenger, and Snapcash.

What’s more, Millennials aren’t just seeking payments technology, they’re demanding it. As the first generation to grow up on devices, Millennials are in the vanguard of the distinctive shift towards a cashless society and enhanced digital transactions. Moreover, Millennials are the next generation of spenders, accounting for $600 billion dollars in purchases each year.

As Gen Y ages, retailers must prepare for this changing of the guard. Let me explain why.

Societal Shift

Deemed the largest share of the American workforce, Millennials possess contrasting opinions on the payments world compared to generations past, a reality that will transform the industry.

In sharp contrast to their parents, 63% of Millennials do not have a credit card and 73% are more excited about financial services from Amazon, PayPal, and Square than from nationwide banks.

This open-mindedness requires flexibility. Categorically, Millennials have fleeting loyalty and are constantly in search of the next big thing. In fact, one in three are open to switching banks in the next 90 days, giving payments providers opportunities to experiment with app solutions and offers to convert users.

With the rise of mobile wallets, there’s significant chatter about what’s to come in the world of payments. Millennials are up for the challenge. Nearly 70% believe paying for things and accessing money will be different in five years. But change is already on the horizon. Some 26% of Millennials aim to use digital currencies in the near future, more than the national average, and 20% have not made a cash purchase over $5 in the past 30 days. Meanwhile, twice as many Millennials are likely to use a mobile wallet in the next 12 months as those 35 years or older.

There’s no doubt that Millennials are the most social generation. With Gen Y flocking to Facebook, Twitter, and emerging social media, it makes sense that payments solutions with a social integration would see steady adoption. Among such utilities are Venmo and Facebook Messenger, which not only allow Millennials to digitally transfer funds, but also engage with friends within popular social networks.

Venmo made a splash back in 2009, inviting audiences to send money to friends via debit card integration (fans can also connect to credit for a small surcharge). Owned by PayPal, Venmo allows its predominantly Millennial users to make financial transactions with just a tap of a smart phone and includes a strong social component, a feat that speaks to the founders’ ultimate goal.

Those who integrate their account through Facebook can share whenever they send or receive a transaction, including who they paid and what for, spurring further activity and adoption. And it’s working. In the third quarter of 2014, Venmo processed $700 million in payments, up 50% from the previous quarter.

Social media aside, Venmo resonates with Millennials on a deeper level, smoothing their interpersonal interactions. Dial back to your own youth and the relentless shuffle over the dining check, crumbled cash and discarded coins scattered about the table. Payment services like Venmo eliminate the awkwardness of asking friends to cover the bill, as Millennials prefer not to make cash transactions.

Facebook plunged further into the payments world in March, enabling peer-to-peer payments in its Messenger app. Such an integration allows users to converse with friends and complete banking transactions all in one stop. Peer-to-peer payment apps significantly streamline the banking experience, giving Millennials the flexibility they crave and further enhancing mobile-mindedness.

Catching the Wave

So, what is a merchant to do to take advantage of this shift? How can a mcrchant catch the wave and not be crushed by it? First things first. Adopt an open-loop POS system. Not all systems are created equal. Be sure you have a cloud-based system that is built with open architecture allowing for easy adoption of new tools, backed by a high-touch service provider.

As new things come along, these providers will curate the best new technology and integrate them within your system. Tablet-based POS systems with EMV and near-field communication (NFC) readers that are built with open-loop architecture provided by a one-stop supplier are a safe bet.

Second, develop close data-driven relationships with Millennials. The latest payments systems provide real competitive advantage for those willing to adopt them. This includes tracking not only what was sold, but keeping close tabs on who bought it.

The new infrastructure allows savvy merchants to leverage the upcoming generation’s willingness to accept deals and offers in exchange for being tracked, a win for both Millennials and merchants alike. These deals and incremental sales are all driven by sophisticated systems that track, analyze, and delight.

Finally, don’t be afraid to innovate. The iterations of new tools and new approaches, while already numerous, will only increase. Sticking with a provider that is at the forefront of these changes is key. A trusted advisor will steer merchants clear of wasted efforts.

However, open-mindedness is also important. Think like a Millennial. Be willing to try new things. Stay up on the latest. This will keep you at the forefront of this trend toward a cashless society, thriving and growing.

The days of counting coins and hiding money under mattresses may be behind us, but all movements have a trail effect. The shift to mobile payments will not happen overnight. For at least a little while longer, we can expect traditional banking models to remain intact.

But as technology continues to flourish and mobile-wallet adoption expands, Millennials will lead society into a new era of payment processing, smart phones at the ready.

—Norm Merritt is president and chief executive of ShopKeep.com Inc.