New rules coming from the CFPB and other regulators will likely lead to exits and consolidation among players, says Ben Jackson.

It’s February, and by the end of the first quarter the rules of the prepaid game likely will change. Looming regulations at both the federal and state level likely will cause many providers to re-evaluate their businesses and make changes, if not exit altogether.

The Consumer Financial Protection Bureau has been working on a set of prepaid rules for more than three years, and it looks like the final rules will finally come in 2016. In May 2012, it issued an Advance Notice of Proposed Rulemaking to gather information about disclosures, unauthorized transactions, and product features. Then, in December 2014, it issued 870 pages of proposed regulations that cover everything from prepaid card disclosure to overdrafts to person-to-person payments to (possibly) virtual currency. Note that the entire Durbin Amendment regulations were implemented with only 307 pages.

After a comment period and public hearings, the CFPB went behind closed doors to finalize the rules. Since that time, RushCard cardholders ran into trouble using their cards when the company switched processors and experienced an outage. The CFPB sought complaints from RushCard cardholders, and concern has grown that the final rules may try to govern processing as well as the multitude of topics in the original proposal.

In the proposed rules, the definition of prepaid included anything that could store value that wasn’t for a “needs-tested” benefit, a gift card, or a health-savings account. Person-to-person payments, such as those managed by Dwolla and Venmo, or even PayPal, could be covered under this definition.

The Bureau has tried to make the rules cover as much as they can. Even programs like child-support and unemployment cards are expected to fall under their purview.

Major Disruption

If the rules come out in the spring, as expected, there will likely be a major disruption in the prepaid card business. Depending on the implementation time frame given for compliance, program managers may need to recall and destroy mountains of cards and marketing materials.

It’s clear the CFPB is not the Environmental Protection Agency (given the reams of paper needed to print out its last set of regs, it might even be the EPA’s sworn enemy). All the same, it would be nice to avoid a repeat of 2009’s Credit Card Accountability, Responsibility, and Disclosure (CARD) Act, which led to piles of unusable cardstock being landfilled.

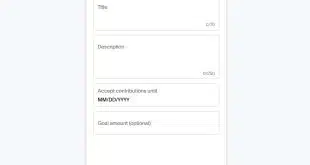

One area that is guaranteed to change is prepaid disclosure rules. Prepaid providers have already begun redesigning their packaging and rejiggering their terms and conditions. Questions remain around how much disclosure will need to be provided and in what order.

As long as there are no dramatic changes in the final rules, many providers will be largely prepared. But implementation timelines could put some of them under pressure to get new materials printed. Many will need to change how they interact with clients and cardholders, making sure that payroll-program sponsors provide the proper disclosures in the correct order, for example.

The real struggle is that the CFPB is only the latest in a series of agencies that have jurisdiction over prepaid. The Federal Deposit Insurance Corp., the Comptroller of the Currency, the Department of Justice, the Financial Crime Enforcement Network, and the Federal Trade Commission have all had a hand in regulating the business. They were recently joined by the U.S. Department of Education, which set rules on how colleges and universities can disburse funds to students. This led Higher One Holdings Inc. to sell off its disbursement business in December.

That’s not all. State governments have their say. A proposal in New York concerning payroll cards has a number of providers concerned over their future in that state. The most concerning provisions are a mandatory seven-day waiting period before an employee could get a prepaid card, and the elimination of certain ATM fees.

The waiting period would force unbanked workers to receive at least one check. While employers are supposed to provide employees with some way to cash their checks for free, this is a limitation on one class of people through one form of financial services. Beyond that, the elimination of ATM fees could make payroll cards in New York unsustainable.

As is often the case, a well-intentioned effort to protect consumers could, in the end, harm them. Those people who are unable or unwilling to get bank accounts would be left with no electronic options for payroll in the state of New York. They would be forced back into using high-cost alternative financial-service providers.

New York is just the first state to propose regulations. Other states may soon follow.

Protecting Choice

If all of these regulations are applied to the industry, expect additional consolidation. Only those companies that can maintain a large enough compliance department and a diverse enough product set will be able to survive.

Changes are already happening, some of them influenced by regulation. JPMorgan Chase stopped selling open-loop gift cards, a move that was likely driven by rules resulting from both the CARD Act and the Durbin Amendment to the Dodd Frank Act. The Higher One sale mentioned earlier was driven in part by regulation.

Consolidation has begun among independent program managers, as evidenced by Green Dot’s recent purchases of AccountNow and the AchieveCard. The influence of coming regulations is not yet clear, but it is likely the CFPB’s pending rules played a role in these decisions.

Looking ahead, 2016 could reshape the prepaid industry. Providers will need to evaluate their businesses, work with their counsel, and continue to work to shape regulations.

For many prepaid segments, such as payroll, it is not just about protecting the prepaid business, but also a matter of protecting consumer choice and financial security against rules that would abandon low-income workers to high-cost financial services.

—Ben Jackson is director of the prepaid advisory service at Mercator Advisory Group, Maynard, Mass. Reach him at bjackson@mercatoradvisory group.com.