FedNow is set for commercial launch next month, but if you’re wondering how the Federal Reserve’s shiny new real-time payments service is going to be used and what it will cost, just look at how early participants are putting it to work now.

As Digital Transactions learned this spring, the nation’s banking regulator, along with some of those early users, have already seen some clear patterns in the real-time payments service. That became clear during a panel discussion at ETA Transact, a payments conference in Atlanta organized by the Electronic Transactions Association.

Business-to-consumer payments and payroll are two of the most popular applications so far, said panel participant Tim Boike, vice president for industry relations at the Federal Reserve Bank of Chicago. But that’s not all. Boike also pointed to “a lot more activity” in areas such as bill payments, disbursements, and account-to-account transfers.

Add to that cross-border payments, which are attracting “a ton of interest,” panelist Stephen Aschettino, partner and head of U.S. fintech at London-based law firm Norton Rose Fulbright, told the audience. Payroll funding through earned-wage access is also a popular application, he added.

But FedNow isn’t the only game in town. It has rivals that have been operating for some time, among them The Clearing House Payments Co. and, lest we forget, the card networks. It turns out Visa Inc.’s Visa Direct network is attracting usage in areas the giant card network never considered, including merchant settlement, said panelist Ky Tran-Trong, vice president and associate general counsel for global regulatory affairs at Visa.

Just how and where FedNow will get a workout is of interest because the Federal Reserve first proposed a national real-time payments network in 2019 and has spent the past four years developing it.

Indeed, Boike was careful to outline how the Fed system may differ in crucial ways from its competitors. With FedNow, “We’re talking about instant settlement within master accounts at the Federal Reserve,” he said. He added the service has “direct connections to many of the financial institutions in the United States.” Also, FedNow will be a credit-push platform. “No debit allowed,” Boike pointed out.

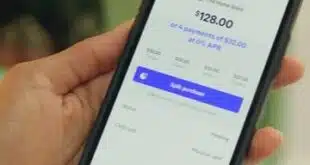

Boike confirmed FedNow will charge a flat penny per transaction to the requestor, paid by the party that requests the instant transfer (senders pay 4.5 cents). Transactions will be capped at $500,000.

But pricing is far from users’ only concern. There’s also the crucial matter of fraud (see our cover story on page 20 for more detail). Tran-Trong issued a warning: “There needs to be new fraud tools on top of these payments.”

—John Stewart, Editor john@digitaltransactions.net