The payments industry has forged a symbiotic relationship with cloud computing.

That isn’t likely to be swept away any time soon.

More than two years ago, Global Payments Inc. took a big leap into marrying cloud computing with payments. The big payment processor signed an agreement with Amazon.com Inc. to use its Amazon Web Services for a cloud-based issuer-processing platform. At the time, Global Payments said the platform handled 27 billion transactions annually.

Within a year, the Atlanta-based company said its acquiring technology would migrate to Google Cloud. It would also act as the worldwide merchant acquirer for Google.

These actions would prove to be transformational.

Earlier this year, Visa Inc. announced its Visa Acceptance Cloud, a new platform that enables acquirers, payment service providers, point-of-sale system makers, and Internet of Things developers to move payment-processing software from hardware devices to the computing cloud.

Then, this summer, tech giant Oracle Corp. launched its Oracle Food and Beverage Payment Cloud Service to offer contactless payments and mobile-wallet acceptance with fixed rates—not long-term contracts or monthly minimum-volume requirements. The move is expected to make it easier for restaurants to accept multiple payment methods without requiring multiple software integrations.

“The role of cloud computing in our business is growing, driven by the explosion of services we offer through our cloud-based API gateway,” says Jason Sharples, Global Payments’ executive vice president and chief technology officer for merchant acquiring.

“Today, the majority of our merchant services are available this way,” Sharples adds. “But cloud computing is much more than just running things in the cloud. We’re adopting cloud methodologies, where we can, to optimize our internal development and delivery practices.”

Mobile First

Global Payments is not alone is this transformation. “Today, payments are at the center of all human activities,” says Vugranam Sreedhar, distinguished engineer at Kyndryl Holdings Inc., a New York City-based information-technology infrastructure services provider. Kyndryl was spun off from IBM Corp. in 2021. “As our world becomes increasingly more digitized, cloud computing has become fundamental to enabling modern payment services,” Sreedhar adds.

The cloud, in the sense of a network of physical servers linked by Internet connections, has existed as a concept for some time. But there are lots of reasons cloud computing in general has blossomed. For payments, it has a special appeal because it can move the transaction off a dedicated device, leaving behind many security issues associated with physical devices.

Cloud computing in payments gained a lot of ground when tablet-based point-of-sale systems emerged. Built on Apple Inc.’s iPad and tablets using Google’s Android operating system, these systems use customized software and Internet access to alleviate many merchant headaches regarding security and compliance with PCI Security Standards Council requirements.

They also empower smaller merchants, which typically could not afford advanced POS systems that provide functions such as sales reporting, employee time management, inventory reports, and content-management system access—features that much larger organizations have traditionally used.

The first iPad and Android tablets launched in 2010, but it took time for these devices to make inroads as POS systems. Even now, they haven’t completely displaced the conventional countertop terminal. Mobile point-of-sale devices also played a role in raising the profile of payments for smaller merchants.

POS software from Square was an early player—it launched in 2009—in creating cloud-based payments services. The Square dongle, joined by others, soon became common. Now, payment terminals designed as mobile devices first are prevalent just as tap-to-pay on iPhone capability comes into the market, bypassing terminals and dongles completely in favor of the consumer device.

“Many small and midsize enterprises still use standalone payment terminals, just providing the ability to take card payments,” says Ron van Wezel, strategic advisor for retail banking and payments at Aite-Novarica Group, a Boston-based consultancy. “Enterprise merchants can integrate payment software through the APIs into their business applications, but such integration used to be out of reach for SMEs.”

The arrival of mobile POS changed that, he says. “MPOS provides a card reader connected to a basic [electronic POS] app running on a tablet or smart phone. Merchant onboarding is simple and fast, and the service is delivered on a pay-as-you-go model.” Initially developed for micromerchants, the technology has since been welcomed by larger ones.

“The next stage in this evolution is the availability of dedicated tablet-based EPOS software for SMEs, provided in the cloud on a subscription model,” van Wezel says. “This development empowers SMEs with access to business intelligence similar to that of large enterprises, with payments integrated as just one of the many functions that the business needs.”

Cloud Connectivity

Being able to offer payment and related services to merchants of all sizes is vital, especially as scale is increasingly important to payments providers. “In addition to enhanced product delivery and reliability, as well as improved productivity as a company, a key advantage of the cloud is our ability to provide point-of-sale software that is both hardware-agnostic and uniquely suited to the needs of the various verticals that Global Payments services,” Sharples says.

The cloud affords companies like Global Payments the adaptability necessary for today’s payments industry. Kyndryl adds that approximately 50% of his firm’s customers are in the financial-services industry.

“In its simplest form, making payments available on the cloud opens the door for new ways for organizations to increase efficiencies and streamline processes,” Kyndryl’s Sreedhar says.

“For example, a business could leverage cloud technology to receive identity verification from a consumer’s financial institution with each credit card transaction, reducing the risk of fraud.” Sreedhar adds. “Another organization may leverage the cloud to increase communication with their customers while simultaneously reallocating internal resources by implementing real-time end user alerts.”

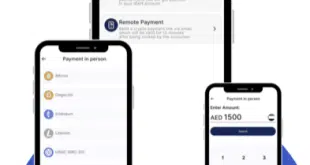

The cloud has enabled technologies such as MagicCube Inc.’s i-Accept platform for mobile Android devices and Apple’s Tap to Pay on iPhone to extend payment acceptance beyond a dedicated payment device to an over-the-counter, commercially available mobile device.

“We minimized what’s on the device and took a lot of it to the cloud,” says Sam Shawki, MagicCube’s chief executive and cofounder. “We left a small footprint on the device.” That’s important to understand because payments in the cloud almost always are not 100% in the cloud, he says. “When you go to the store and put your card in to be read, it’s a conversation between the card and the device that accepts it,” Shawki says.

Earlier this year, MagicCube released an i-Accept version for enterprise and big-box merchants. It added multi-acquirer and multi-merchant support and direct integration capabilities, among other features, to its earlier version.

But that connectivity to multiple processors resides in the cloud, Shawki says. Key management—critical for ensuring a transaction is cryptographically secure—is the cloud too, he says. “The important piece in the device is the high-security level our trusted environment provides,” Shawki adds.

Chucking Checkouts

In addition to the ease of collecting payment data residing in the cloud, many organizations can learn more about their users.

“Cloud-based payments have allowed us to unify the customer journey in ways that were previously not possible,” says Tony DiPaolo, vice president of retail solutions at Manhattan Associates, an Atlanta-based supply-chain and omnichannel-commerce technology provider. “The same payment technology powering online experiences can power physical retail experiences, leading to delivering truly omnichannel experiences.”

That data, which not only can reveal buying patterns and related sales information, also can be applied to advanced computing technologies, such as artificial intelligence and anti-money laundering applications, to make them more predictive, DiPaolo says.

“In doing so, we will be able to do everything from better predicting demand to replenishing inventory before it is even purchased, and see where the inventory is so it can be shipped from the shortest distance possible in the quickest time,” he says.

Recent Manhattan Associates research found that two-thirds of consumers would prefer to ditch traditional in-store checkouts, DiPaolo says.

“Advancement in cloud-based payment technology is one of the reasons we are quickly moving towards a world where customers can ditch long checkout lines and pay from anywhere in the store, in multiple ways,” he says. “With increasing pressure on the operating margin in retail, it’s safe to say that cloud-based payments is one of the core strategies retailers can take to evolve their business in the most cost-effective way while maintaining growth and building customer loyalty.”

Cloud computing has had a democratization effect on access to payment technology, especially for smaller merchants. As Sharples says about the Global Payments partnership with Google, “This game-changing collaboration democratizes technology for SMBs, enabling them to seamlessly manage payments, launch marketing campaigns, enable omnichannel ordering, offer loyalty programs, and more.”

‘A Seismic Leap Froward’

Cloud computing has already helped the payments industry evolve, and there’s no doubt it will continue to have an impact on payments. The form or forms that will take is uncertain. One possible outcome may further erode the presence of hardware terminals.

“The question is if, or when, the final step can be made and the hardware terminal will disappear,” van Wezel says. “Payment acceptance will then become as easy as downloading an app, with all the functionality and security programmed in software.”

Apple and MagicCube illustrate the first steps in this direction.

“The jury is still out on whether the hardware terminals can be replaced altogether,” van Wezel says “But the act is that the value chain and distribution model of traditional acquirer and independent sales organization is already challenged by fintech providers of mPOS solutions, particularly for the SME segment. Acquirers must focus on the business needs of their customers, offering solutions that center around business intelligence, not payments alone.”

At Global Payments, the future with the cloud means it can more easily reconfigure its offers. “For Global Payments, moving to the cloud means we can recompose our business capabilities so that we’re offering services at a lower cost with greater agility and more innovation,” Sharples says.

“Before the cloud, for example, you often had overlapping card authorization systems for different lines of business,” he adds. “In the near future, only one authorization service will be needed, because the cloud methodologies enable us to abstract business capabilities as services that can be consumed independently and plugged in anywhere. That enables us to scale innovation faster and at a lower cost, making the business capabilities more attractive to customers.”

Large or small, fintech or long-standing payments players alike view cloud computing as essential. It has become a part of payments that is unlikely to be decoupled.

As Manhattan Associates’ DiPaolo says, “Cloud computing has been a seismic leap forward for the payments industry. What was historically a commoditized product for retailers can now be leveraged as a competitive advantage. Retailers using technology in tandem with a cloud-based payment service provider have the ability to operate in near real-time. Essentially, [the] cloud has moved the entire industry from a reactive operating model to a proactive model.”