Acquiring TIO Networks gives PayPal an all-important launchpad for reaching consumers underserved by banks. How will it leverage that asset?

PayPal Holdings Inc.’s $233-million acquisition of Vancouver-based processor TIO Networks Corp., which was finalized in July, does more than make the digital-payments system an immediate player in the bill-payment market. It provides the gateway PayPal needs to become a preferred provider for a huge market: consumers underserved by banks.

Since eBay Inc. spun off PayPal as an independent company in 2015, PayPal president and chief executive Dan Schulman has made it clear the company is intent on becoming a part of the everyday financial life of underbanked and unbanked consumers. But reaching this consumer segment, payments experts say, requires a local presence, not a virtual one. That’s because a physical presence in the neighborhood establishes a bill-pay operator as a trusted resource.

That’s where TIO’s fleet of 900 kiosks and 65,000 payment locations come in. These assets give PayPal the physical presence it needs to establish trust in its brand and services. That trust can then be leveraged to offer target customers additional financial services, such as prepaid cards and loans.

Underbanked consumers are individuals without sufficient access to financial services and products, such as online bill payment, despite having a checking or savings account. Unbanked consumers do not have an account with a financial institution. Typically, these consumer segments turn to non-banks for financial services

“PayPal has been reaching out to consumers on the fringe of financial services, and TIO provides PayPal with the physical-access points these consumers want and will use,” says Michael Moeser, director of payments for Pleasanton, Calif.-based Javelin Strategy & Research. “For PayPal, bill pay can be an access point for providing other financial services to this consumer segment, but first they need that access point.”

‘Banks Haven’t Done a Good Job’

Make no mistake, PayPal has no shortage of financial services it can offer to bring underserved customers into its digital market. First, there’s Venmo, PayPal’s mobile person-to-person payments solution, which it got as part of its 2013 acquisition of the merchant processor Braintree. Then there’s PayPal Credit, which offers a line of credit from Comenity Capital Bank.

And even before the TIO deal, the company had established a toehold in bill payment and remittance with its $890-million acquisition of the digital-remittance firm Xoom in 2015. Then there are PayPal’s prepaid card and traditional PayPal accounts that can be used to make online purchases.

“In this era of mobile technology and advanced software platforms, more can be done to better serve consumers using alternative financial services,” says a PayPal spokesperson. The company did not make an executive available for this story. “We see tremendous opportunity to extend TIO’s services and reach through PayPal’s two-sided network, growing consumer base, and our global reach,” the spokesperson continues.

Consumers underserved by the banking community represent a substantial market opportunity. PayPal puts the worldwide figure for this market segment at more than 2 billion people.

In the United States, about 24.5 million households, or about 20% of all households, were underbanked in 2015, according to the latest figures from the Federal Deposit Insurance Corp. That figure is unchanged from 2013, the FDIC says. In addition, 7% of U.S. households were unbanked in 2015, says the FDIC.

Increasing the attractiveness of these two consumer segments to PayPal is that more than 55% of the unbanked and 17% of the underbanked perceive banks as being uninterested in serving their needs, according to the FDIC. In 2015, 24% of all U.S. households, including the unbanked and underbanked, used an alternative financial services provider, the FDIC says.

“Banks haven’t done a good job of reaching this market segment,” Moeser says.

‘Opportunity to Disrupt the Status Quo’

TIO’s more than 16 million consumer bill-pay accounts give PayPal a sizable beachhead within the unbanked and underbanked communities to expand the services offered through TIO.

A logical first step for PayPal would be to expand its relationship with TIO users by offering them an opportunity to open a PayPal account, says Rick Olgesby, president of AZ Payments Group LLC, a Mesa, Ariz.-based consultancy. In many ways, opening and funding PayPal accounts through TIO kiosks would be an outgrowth of a new account-funding method called PayPal Cash, Olgesby adds.

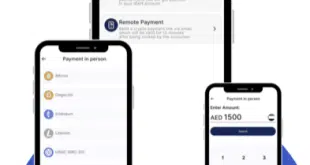

To load money through PayPal Cash, a consumer logs into her PayPal account, selects “add money,” and clicks the PayPal Cash button. The customer receives a barcode, which is scanned by a PayPal Cash merchant. The merchant then enters the amount to be deposited into the consumer’s PayPal account and then accepts the funds from the consumer. PayPal accountholders are charged $3.95 per transaction for the service.

In 2016, 7-Eleven Inc. became the latest merchant to join the list of PayPal Cash locations, making the program available at 8,000 stores in the U.S. Other PayPal Cash merchants include CVS and Rite Aid.

Paying a bill through a TIO kiosk is not much different. To pay a bill using TIO, a consumer enters the name of the biller to be paid, such as her Internet service provider, her account number, and the amount to be paid. Next, the consumer selects the payment method, such as cash, credit, debit, or automated clearing house network. If paying by cash, the consumer deposits the money into the kiosk.

“There is no reason that money put into a TIO kiosk can’t be directed to a PayPal account, which could also be used to pay bills,” says Olgesby. “Once a consumer has a PayPal account, all of PayPal’s other financial services become an option.”

Converting TIO users into PayPal accountholders also opens the door for PayPal to begin moving those customers to its mobile app, where they can be exposed to other PayPal financial services. PayPal says it intends to integrate TIO bill pay within its online and mobile experiences, but will not elaborate.

Moving TIO customers to the PayPal mobile app represents a big opportunity to bring those consumers into the world of digital payments, says Jared Drieling, director of business intelligence for The Strawhecker Group, an Omaha, Neb.-based research firm.

“The unbanked and underbanked have traditionally been served by the likes of Western Union and MoneyGram,” Drieling says. “It is a space that has not been innovative, so the opportunity to disrupt the status quo is great, especially by leveraging the mobile channel. The kiosk bill-pay opportunity is more of a bridge to digitalize these types of consumers.”

Many of the unbanked and underbanked are already Internet-savvy from surfing the Web on their smart phones, says Thad Peterson, a senior analyst for Boston-based consultancy Aite Group. “A lot of these consumers are already familiar with PayPal and see it as a low-cost alternative financial-services provider,” he adds.

‘Building Trust’

But PayPal isn’t the only player in the bill-payment space that’s aspiring to move the unbanked and underbanked into other digital-payments services. For example, Maya, a Sherman Oaks, Calif.-based provider of self-service payment terminals, is also looking to leverage its position as a bill-payment kiosk provider to offer other financial services.

For about a year, Maya has been piloting 10 bill-payment kiosks, the majority of them in Southern California. As with TIO, Maya users enter the name of the biller they want to pay, their account number, and the amount to be paid, and then insert the cash to pay the bill. About 66% of transaction volume is from repeat customers, says Pete Kelly, Maya’s chief business officer.

Besides paying bills, consumers can also purchase gift cards from such retailers as Wal-Mart and Amazon, as well as other merchants such as Uber, eBay, and Southwest Airlines. Altogether, consumers can purchase gift cards for more than 200 leading brands, the company says.

Access to gift cards, which are electronically delivered to consumers by email or mobile phone in the form of a code, enables Maya users to shop online, something they can’t do without a credit or debit card or a PayPal account. To make an online purchase, consumers simply enter the code at checkout. Consumers are charged $2 per transaction.

In addition, Maya users can top off their mobile phones through the kiosks. Maya, which was founded in 2016, works with more than 550 mobile carriers servicing 4.5 million phones in 135 countries.

These services are just the tip of the iceberg, says Kelly. Consumers can initiate money transfers to more than 120 countries through Maya kiosks. Recipients can pick up the cash at any of 200,000 locations. The average remittance through Maya is about $320.

Many of Maya’s customers make multiple purchases or transactions when paying a bill, Kelly says.

Now, plans are in the works to add check-cashing capabilities by year’s end to make bill payment easier. “There is a lot of convenience to being able to pay bills, purchase a gift card, send a remittance, cash a paycheck, and receive other financial services in one location,” Kelly says.

But bill payment is just one arrow in Maya’s financial-services quiver. The company has also developed a mobile app that allows consumers to cue up bill payments in advance of going to a kiosk, view their transaction history, purchase gift cards, and locate Maya kiosks.

“The mobile app is a financial-management tool, but in time we can expand the financial services offered through it,” Kelly says.

Key to expanding the breadth of financial services, Kelly says, is to do it incrementally. “It comes down to building trust with the customer. As consumers come to trust our brand, we can add more services.”

‘An Expensive Play’

But operators like Maya, and even PayPal, face the hard reality that kiosks are a costly way to acquire and service customers. As attractive as the TIO acquisition appears, some payment experts are not entirely sold on the idea that PayPal will nurture or even grow TIO’s fleet of kiosks.

“Kiosks are an expensive play, and deployers need distribution and volume to make them work,” says Peterson. “When it comes to offering financial services, I see more of a mobile play from PayPal as it moves toward becoming an acceptance brand. The unbanked and underbanked have mobile phones.”

Others, though, argue the kiosk network will serve PayPal well for the time being. While providing financial services through its mobile app may be PayPal’s ultimate endgame, the company will still need kiosks and retail locations to accept cash from unbanked consumers for the time being, Olgesby says. “Before PayPal makes a mobile play for the unbanked and underbanked, it has to get their cash into its system. [Physical] money can’t be put into a phone,” says Olgesby.

At its core, the acquisition of TIO is another building block in PayPal’s strategy of becoming the financial-services provider of choice to consumers underserved by banks. The addition of TIO’s kiosks and retail outlets not only enhances the value of PayPal’s breadth of services, but also its brand, some observers say.

“To change consumer behavior among the unbanked and underbanked, PayPal needs to offer a model that is different, viable, and efficient,” says Olgesby. “TIO gives them a transactional engine that can enhance customer relationships and help them become the bank for the unbanked.”

A TIO Snapshot

Headquarters Vancouver, British Columbia

Founded: 1997

Original Name: Info Touch Technologies Corp.

Kiosks: 900

Walk-in Locations: 65,000

Consumer Accounts: 14 million

Billers Served: 10,000

Transactions (2016) : 60 million

Dollar Volume (2016) : $7 billion +

Source: Company reports, Digital Transactions News