Mastercard Inc. unveiled plans late Wednesday to tokenize card numbers for all online transactions globally by 2030. The move will make the need for physical card numbers, passwords, and one-time codes for online purchases obsolete, the network says.

Tokenization masks in-the-clear card numbers with digits that would be indecipherable to any entity that might intercept a transaction.

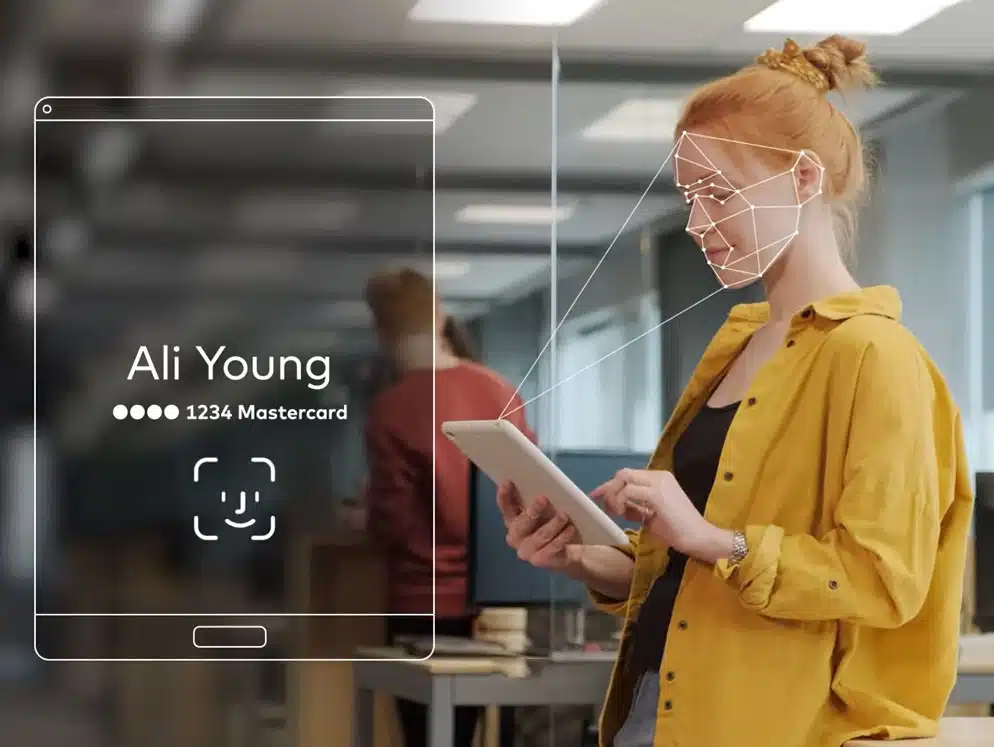

Mastercard plans to combine tokenization with biometric authentication and Click to Pay to phase out manual card entry and static passwords. Currently, more than 30% of Mastercard transactions worldwide are tokenized through the Mastercard Digital Enablement Service. Some markets, such as India, are nearing 100% tokenization for e-commerce, the network adds.

Driving Mastercard’s push for tokenization are high fraud rates for online transactions. Online fraud is seven times higher online than for in-store purchases, the network says. Other factors behind the plan include a finding that nearly two-thirds of online shoppers encounter friction when manually entering their card details and 25% of online shopping carts are abandoned because checkout is too complex or slow. Tokenizing card numbers across its network will make online checkout smoother and safer, Mastercard says.

Mastercard’s tokenization technology has shown it can speed online transactions, as well as reduce shopping-cart abandonment and grow transaction approvals by three to six percentage points, the network says. As a result, merchants are collectively seeing up to $2 billion in additional sales globally per month, according to Mastercard.

While many card issuers and merchants have been adopting tokenization, Mastercard still faces challenges in achieving its goal.

“Tokenization has been around for some time, but it is going to be a challenge to convince merchants that feel they have no need to modernize their system because it works to integrate this technology,” says Cliff Gray, principal, Gray Consulting. “While this is a technology that will benefit merchants, it is not something they are likely to see as moving the needle on their bottom line,” which poses a challenge to adoption.

Mastercard did not respond to questions from Digital Transactions News regarding its strategy.