New consolidated industry data show the number of substitute checks, or image replacement documents (IRDs), flowing through image-exchange networks surpassed 100 million for the first time in June, but the share of paper relative to all image-exchange volume is declining. According to the Electronic Check Clearing House Organization (ECCHO), the total number of imaged checks forwarded by financial institutions through all image-exchange networks in June was 206.8 million, up 993% from 18.9 million items in June 2005. Some 89.4 million items cleared electronically, representing 43% of the June total. The number of substitute checks hit 117.4 million, or 57% of all items. A year earlier, IRDs represented 86% of the much lower volume. The Check Clearing for the 21st Century Act, the so-called Check 21 law that became effective in October 2004, gave legal status to substitute checks, which are paper printouts of check images used by financial institutions not equipped to receive imaged checks. Many observers have been disheartened by the volume of IRDs, which negate some of the savings of fully electronic image exchange (Digital Transactions News, May 26), but ECHHO believes they're a mere steppingstone to full imaging as more and more banks get technologically up to speed. David Walker, president and chief executive of Dallas-based ECCHO, wouldn't predict when the total number of IRDs will start to decline, but he notes that 3,990 U.S. routing numbers, a close proxy for individual financial institutions, could receive images in June, up from 2,615 at the end of 2005. “Certainly by the end of 2007 we expect all of the larger banks to do image exchange,” he says. The value of imaged checks in June was $571 billion, up 215% from $181 billion in June 2005. A clearing house that develops check-industry rules and education programs, ECCHO compiles its figures from imaging data reported by the Federal Reserve and private image networks SVPCO, a unit of The Clearing House Payments Co. LLC, and the National Clearing House (NCHA), which processes for the Endpoint Exchange, a national network owned by Metavante Corp.

Check Also

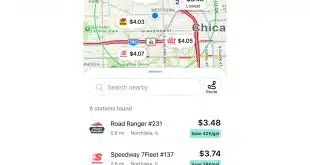

C-Store Chain RaceTrac Deploys 10-4 by WEX for Cardless Fuel Payments

RaceTrac Inc., an Atlanta-based convenience store chain with more than 800 locations, is debuting cardless …