With chargeback costs poised to grow an estimated 52% by 2023 for U.S. payment card issuers alone, issuers as well as merchants and merchant acquirers have every incentive to reduce those costs. And one way they could do it is by providing more transaction detail on consumers’ online credit card and bank statements, according to research firm Aite Group LLC.

In a report released Wednesday, Boston-based Aite says the annual chargeback cost to U.S. issuers was $585 million last year, an expense that will grow to an estimated $690 million this year and to $1.05 billion by 2023. Aite pegs the cost of resolving a single chargeback at $25.

Chargebacks are increasing in part because overall payment card transactions are growing, according to Aite. Fraud, of course, remains a major factor. And some issuers have implemented digital processes for filing non-fraud chargebacks, which has also is pushing volumes up.

Aite’s findings in its “Improving the Dispute Experience: Transparency Is Power” report are based on a January survey of 1,004 consumers and interviews with 10 large North American credit and debit card issuers, as well as some large e-commerce merchants, from last November to February. Ethoca, a dispute- and fraud-mitigation firm that Mastercard Inc. acquired last year, sponsored the survey.

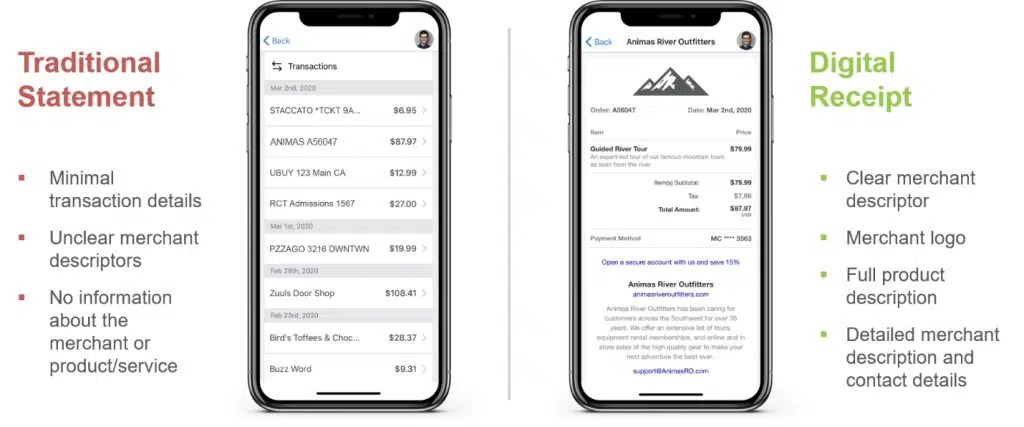

One major source of chargebacks is unclear information about a purchase listed on a customer’s online card or bank statement, spurring inquiries to issuers’ call centers. Clearer information, such as from detailed digital receipts rather than only skimpy line items on statements, could deflect many of those disputes from becoming chargebacks, according to Aite.

“Twenty-seven percent of consumers report that, once they connected with the institution, the charge wound up being correct, which indicates that a substantial portion of call volume could be eliminated if the online statement provided more descriptive detail,” the report says. “An executive at a large merchant interviewed for this report says that his firm is seeing a 65% [chargeback] deflection rate among issuers that have the ability to display enhanced transactional detail, while a large issuer that has deployed enhanced transactional detail indicates that it is seeing a 30% deflection rate.”

The vast majority of cardholders reported they did some research before initiating a call to resolve a transaction they didn’t remember, recognize, or agree with, but only 23% of credit card holders and 22% of debit card holders called the merchant first. More than 70% of cardholders first called the issuer—the entity that gets the formal chargeback process going. “This reality frustrates many merchants, since it impedes their ability to address the dispute before it becomes a chargeback,” the report says.

Enhancing transaction information for cardholders, however, will require more collaboration among issuers and merchants, according to Aite.