New Jersey has implemented a law that prohibits merchants in the state from profiting from credit card surcharging and requires merchants to clearly disclose any surcharges to consumers.

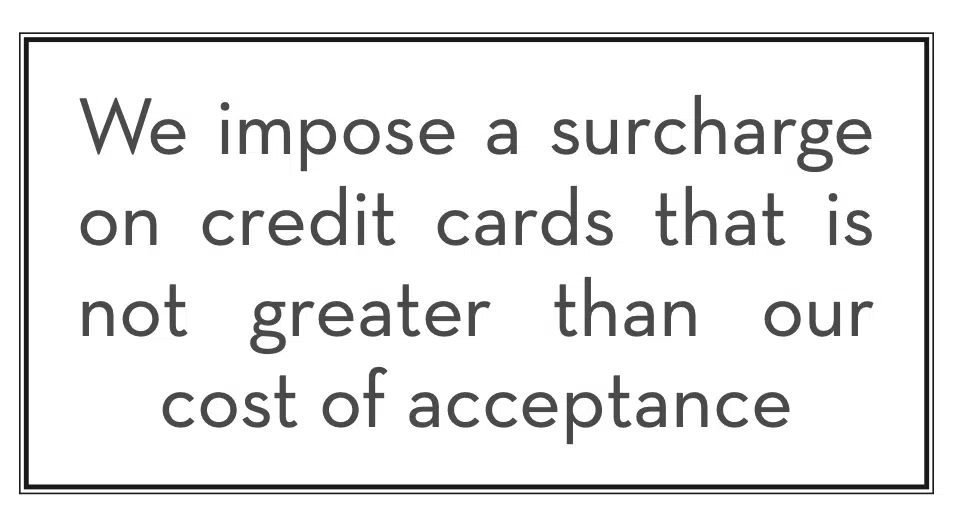

The law, which was passed by the New Jersey legislature in June and went into effect immediately upon New Jersey Governor Phil Murphy’s signature on Friday, allows merchants to levy a credit card surcharge but prohibits them from charging more than what they pay to process credit card transactions. The legislation was crafted with the help of CardX, a Chicago-based provider of surcharging software and compliance solutions.

The aim of the legislation, according to CardX founder Jonathan Razi, was to craft a law that protects consumers by capping surcharges and increases transparency while aligning with industry standards and surcharging best practices.

“Surcharging laws are being passed in some states, and what New Jersey lawmakers wanted was a law that allows merchants to pass along their actual processing costs to consumers, but not have the ability to use surcharging as a profit center,” Razi says. “When it comes to surcharging, you want to be sure there are guardrails that protect consumers, but make sure those guardrails align with industry rules and best practices.”

In effect, the new law will prevent New Jersey merchants from profiting at the expense of consumers who prefer to pay by credit card as opposed to cash, said state senator Gordan Johnson, one of the bill’s sponsors.

CardX, which is part of the payment processor Stax, actively follows surcharging legislation around the country. While most of the proposed legislation does not become law, some bills, such as the one introduced in New Jersey, gain enough momentum to be voted on by the state legislation. “When that happens, we like to get involved to provide industry perspective,” Razi says. “The New Jersey law brings a standardized approach to surcharging with no consumer surprises, which strikes an excellent balance.”

Adds Assemblyman Paul Moriarty, a co-sponsor of the bill, “[Now] consumers will learn about credit card surcharges before they complete a transaction, which will help them make an informed decision about choosing their method of payment.”

Merchant surcharges can vary, though the card companies can regulate them. Visa Inc., for example, this spring issued a rule reducing its surcharge ceiling from 4% to 3%. Surcharges were illegal in all states until 2013, when class-action litigation opened the door to the practice in certain states. Now, all states but Connecticut and Massachusetts allow the practice.