American Express Co. has acquired software developer Center. Terms of the deal, announced late Thursday, were not disclosed. The acquisition is expected to close in the second quarter. The deal will provide AmEx’s corporate and small-business cardholders with an integrated expense-management platform that delivers real-time visibility into all employee spending, …

March, 2025

-

7 March

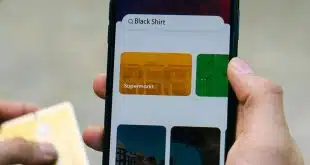

For Many, It’s Device First To Make a Contactless Payment

Ten years ago, the U.S. payment card market made its shift to EMV chip cards, and along with that the industry prepared for more contactless payments. That work by issuers and card brands appears to have paid off because 92% of consumers are now familiar with NFC, the technology that …

-

7 March

Stripe Expanding Chicago Office and other Digital Transactions News briefs from 3/7/25

Stripe Inc. has doubled its office space in Chicago, leasing more than 44,000 additional square feet on the fifth floor of a building in the city’s River North neighborhood and bringing its total space to about 89,000 square feet, according to Crain’s Chicago Business. Business-technology provider Globant announced it has developed systems for …

-

6 March

Grow Your Portfolio — Sign High-risk Merchants in New and Emerging Verticals

Partnering with the right payment technology company to accept as many payment types as possible is a great way for small- to mid-sized merchants to modernize and grow their businesses. Unfortunately, due to the higher level of risk that comes with certain merchant categories, many small businesses have been left …

-

6 March

Riskified Launches Adaptive Checkout; Socure Unveils Its Identity Manipulation Risk Score

E-commerce fraud prevention specialist Riskified has launched Adaptive Checkout, an app created to drive higher conversion rates by reducing false positives. The app leverages artificial intelligence to analyze each transaction based on its risk profile and the shopper’s purchase history. For example, a merchant’s best customers can be sent straight …

-

6 March

Digital Wallet Developers Score a Victory in the Senate

The U.S. Senate on Wednesday voted 51-47 to scrub a regulation issued in November by the Consumer Financial Protection Bureau and aimed at mobile wallets and digital money transfers. The repeal legislation, which now moves to the House of Representatives, comes as major payment-app developers like Apple Inc., Block Inc., …

-

6 March

Priority Revenue up 14% and other Digital Transactions News briefs from 3/6/25

Processor Priority Technology Holdings reported fourth-quarter 2024 revenue of $$227.1 million, up 13.9% year-over-year. Revenue for the year totaled $879.7 million, up 16.4% over 2023. The company’s net income swung to a positive $7.2 million for the quarter from a $106,000 loss a year earlier. For the full year, net income was …

-

5 March

Beyond the Big Processors: What ISOs Really Need to Thrive

By Matt Nern, Managing Partner at SignaPay Being an ISO is a balancing act. Between closing deals, staying on top of evolving payment technology, and ensuring merchants get the support they need, there’s hardly time to deal with the inefficiencies of a slow-moving processor. Yet, too often, ISOs find themselves …

-

5 March

The CFPB Drops Its Zelle Lawsuit As the Senate Looks to Curb the Bureau’s Power

The Consumer Financial Protection Bureau late Tuesday dropped its lawsuit against Early Warning Services LLC, operator of the Zelle person-to-person payments network. The suit had also named Bank of America, JPMorgan Chase, and Wells Fargo as defendants. The financial institutions are three of the seven bank owners of Early Warning. …

-

5 March

Why Skipify Is Adding Discover Tokenization

Online-checkout provider Skipify Inc. is adopting tokenization technology from Discover Global Network to ease checkouts for Discover cardholders. Tokenization replaces a consumer’s actual credit or debit card number with 16 other digits, which can help improve conversion rates for merchants and improve shopper satisfaction. San Francisco-based Skipify says the early …