Visa Inc.’s Visa Checkout online payment service now claims more than 20 million enrolled accounts, the payments giant announced Thursday. The service, which launched in July 2014, also added new merchants, among them major retailers and service companies including Wal-Mart Stores Inc. and its Sam’s Club unit, Avis Budget, and Marriott. Altogether, some 300,000 merchants globally now accept Checkout, Visa says.

The announcement indicates considerable growth for Visa Checkout, which allows users to load cards from any brand into a digital wallet and use them to make streamlined payments online with either a laptop or mobile device. In June 2015, the service claimed 4.5 million users and 125,000 merchants. By February of 2016, that user count had grown to 11 million. Visa does not break out numbers by country or region, but the majority of its Checkout users are in the United States. In total, Checkout is available in 22 countries, with Kuwait, Qatar, Saudi Arabia, and Ukraine scheduled for this year.

Early last year, Visa opened a wide range of some 155 APIs, including code for Visa Checkout, to outside developers.

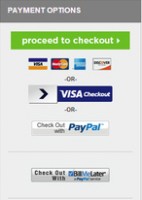

Visa is promoting Checkout as it confronts determined competition from similar services from such companies as PayPal Holdings Inc., Stripe Inc., and Mastercard Inc., which last year revamped its Masterpass digital-payments service, stressing its use for in-store as well as online transactions. In a move to ease access to the crucial tokens that stand in for card credentials in digital payments, Visa and Mastercard in December reached an agreement that allows each company to access tokens for cards branded by the other company.