A San Francisco-based startup that claims to have a better mousetrap for e-commerce checkouts has raised $20 million in a Series A funding round led by a prominent online merchant acquirer, Stripe Inc.

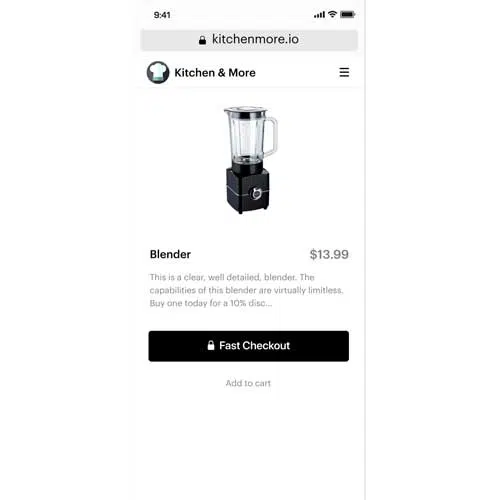

Fast AF Inc. said it will use the funding to accelerate the global rollout of its upcoming Fast Checkout one-click purchase product, and to expand its product and engineering staff. Fast Checkout, which will launch in the coming weeks, will complement the company’s Fast Login one-click login tool and provide one-click checkout on any browser, platform, or device, Fast said in a news release.

The checkout system requires customers to enter their payment information once at enrollment, then eliminates the need for them to remember passwords or input payment data afterward, according to Fast’s Web site.

“This funding rapidly accelerates Fast’s ability to improve the checkout process for billions of people and businesses around the world,” Fast chief executive and co-founder Domm Holland said in a statement. “Now, more than ever, we need to dramatically improve the e-commerce checkout experience, which has remained stagnant for 30 years. We have an even greater commitment to fulfilling our mission of making buying online fast, easy, and safe for everyone.”

Citing data from Barilliance Ltd., an Israel-based provider of customer-retention and data software for retailers, customers abandon up to 80% of potential online purchases “largely due to friction during checkout,” the release says. “At the same time, consumers are forced to fill out an average of 23 fields just to make a single online purchase.”

Digital Transactions News asked a spokesperson what makes Fast better or different from existing checkout systems such as the new click-to-pay (Secure Remote Commerce) system from the card networks, Apple Pay and Google Pay, and Amazon.com Inc.’s payment service. “Existing services like autofill settings on browsers are limited to specific platforms,” the spokesperson says by email. “Fast is platform-agnostic and works across the spectrum, regardless of what browser or mobile operating system you use. This is truly one login to rule them all.”

The spokesperson did not have data available about the number of merchants that will be accepting Fast when the service launches.

“Fast is taking a novel approach to improving the login and checkout process for online businesses,” Jordan Angelos, head of corporate development at San Francisco-based Stripe, said in the release. “We support their vision to remove friction from Internet commerce wherever possible.”

Stripe is the 13th-largest U.S. merchant acquirer and the industry’s largest privately held firm, according to Omaha, Neb.-based consulting and research firm The Strawhecker Group. Primarily an online acquirer, Stripe processed $64.5 billion in payment volume for 1.7 million merchants in 2019, TSG reports.

Fast’s funding round also included participation from existing investors Index Ventures and Susa Ventures. The company’s other co-founder, chief operating officer Allison Barr Allen, is an angel investor who previously led global product operations for Uber Technologies Inc.’s Money Team, Fast says.