The Credit Card Competition Act, if it becomes law, will likely have unintended consequences for the businesses that sign up merchants for payment processing. Not all of them are good. Introduced more than a year ago, the Credit Card Competition Act has quickly become the hottest topic in the payments …

Read More »Search Results for: chargebacks

A Home for Unused Gift Cards And Other Digital Transactions News briefs from 12/20/23

The payouts platform Onbe said it will enable instant payment on virtual Mastercard cards to consumers who want to sell unused gift cards on the CardCash secondary gift card market. Buy now, pay later platform Affirm Inc. said it is expanding to self-checkout kiosks in more than 4,500 U.S. Walmart stores. U.S. households spend …

Read More »The Justice Department Takes Aim at Microtransactions Fraud

The U.S. Department of Justice announced late Friday it is filing cases against several fraud rings that use so-called microtransactions to mask their fraudulent activity from victims and card issuers. The lawsuits are being brought as part of efforts by the Justice Department’s Consumer Protection Branch to stop criminals that …

Read More »Stripe Partners With Fraud Fighter Vesta And Brings Tap-to-Pay on iPhone to Alaska Airlines

Vesta, a fraud-prevention provider for e-commerce merchants, said it will integrate Stripe Inc.’s Radar risk scores and Stripe Connect, which enables businesses to facilitate purchases and payments between third-party buyers and sellers, into its Payment Guarantee platform. The Stripe Radar integration will help Vesta’s client merchants increase transactional approval rates …

Read More »Eye on Crypto: Bitcoin Depot Seals Cord Kiosk Deal; Ripple in RocketFuel Partnership

Bitcoin Depot Inc. looks to expand the installation of its cryptocurrency kiosks in a new deal with Cord Financial Services LLC. Separately, RocketFuel Inc. will adopt Ripple Payments for its payment-products suite. Atlanta-based Bitcoin Depot, which recently expanded the footprint of its BDCheckout cryptocurrency digital-wallet funding program, says it will …

Read More »What’s an Acquirer To Do?

Agents that sell card acceptance aren’t powerless when merchants gripe about the cost. Merchant discontent over card-acceptance fees is nothing new, but every few years the din rises several octaves, just as it has in 2023. While merchants, card issuers, the card networks, and politicians argue over whether acceptance costs …

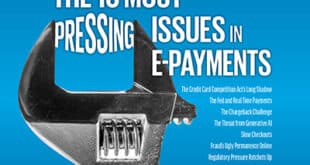

Read More »17th Annual The 10 Most Pressing Issues in E-Payments

We know you’re not looking for problems. But they are looking for you. Here’s our annual catalog of the ones causing the most headaches. If adversity breeds strength, as the old saying goes, then payments professionals may have plenty of opportunity to develop their strategic and tactical biceps. The industry …

Read More »Visa’s Friendly Fraud Rule Change Could Cut $1 Billion From Small Firms’ Chargeback Costs

Visa Inc. is touting recent changes to how chargebacks that could be first-party fraud, also known as friendly fraud, are processed as potentially saving small businesses globally $1 billion in costs over the next five years. Expectations are that the streamlined process will increase merchants’ ability to provide more accurate …

Read More »The Fed on Request for Payment And Other Digital Transactions News briefs from 9/27/23

The Federal Reserve issued a set of market practices, or a kind of blueprint, as part of an effort to introduce standards for a request for payment function for bill pay on the regulator’s FedNow real-time payments service, which launched nationwide in July. Block Inc.’s Square point-of-sale unit launched Tap to Pay on Android …

Read More »How ISVs are Adapting to Rapid Market Shifts

By Tom Byrnes, SVP, Marketing, PayiQ The current ISV market is growing exponentially and is expected to show a compound annual growth rate (CAGR) of 14.1% from 2022 – 2030. This growing scope of opportunity has attracted new players into the market. According to recent research by the Retail Solutions …

Read More »