Merchants continue to pull every lever to generate additional revenue within an increasingly competitive landscape. For them, it is a matter of survival. And while numerous offerings promise equally innumerable benefits, there’s a hidden goldmine that can ensure the growth merchants are looking for: their payments data in real-time. > …

Read More »Search Results for: consumers

DealerPay Shifts to a Higher Gear And Other Digital Transactions News briefs from 12/29/22

Dealer-Pay, a payments-technology provider for automobile dealerships, has integrated its platform with Dealertrack, a management system serving the same industry. Guarda, whose cryptocurrency wallet includes a prepaid Visa card, added five more digital currencies to the 14 it already supports. Supported cryptocurrencies include Bitcoin and Ethereum. Japan-based Smartpay has launched Smartpay …

Read More »MoneyGram Links to CellPay for Bill Pay And Other Digital Transactions News briefs from 12/28/22

MoneyGram International Inc. announced a partnership with bill-payment platform CellPay to expand bill-pay options for MoneyGram users while expanding acceptance for MoneyGram’s service to more than 30,000 billers. Some 3.46% of U.S. consumers opened a new credit card in November, down from 3.7% in November 2021, according to the December 2022 …

Read More »COMMENTARY: A Forecast for Secure Payments in 2023

The world will not stand still in 2023—not in retail and certainly not in payments. For the coming year, security and automation will be the focus of the trends and innovations we’ll be seeing in the payments space. Let’s explore this further. Credit card tokens from Visa, Mastercard, Discover (Diners), …

Read More »Fraud on P2P Networks Hits 12% of Bank Customers in the U.S., J.D. Power Finds

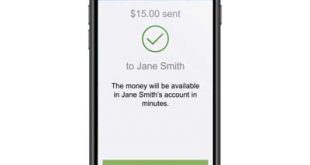

Some 12% of U.S. customers have lost money to fraud on a peer-to-peer payment network, while 11% have seen it happen to a family member, according to survey results released earlier this month by J.D. Power. The networks cited by the respondents were Zelle, Venmo, and PayPal. For the survey, …

Read More »Mechanics Adopts Finastra RTP Service And Other Digital Transactions News briefs from 12/21/22

Payments-technology provider Finastra said Mechanics Cooperative Bank, a financial institution with $645 million in assets, has adopted the Finastra Payments To Go platform to offer real-time payments via The Clearing House Payments Co. LLC and later through the Federal Reserve’s FedNow network. Digital-security provider IronVest Inc. launched what it calls a “super app” for …

Read More »Worldline Adds Splitit as a BNPL Option for Merchants

Global processor Worldline S.A. will make Splitit, a white-label buy now, pay later provider, available to its roster of merchants and marketplaces, starting first in North America. Announced Tuesday, the integration will enable Worldline merchants to offer card-based installment payments within the existing checkout flow. Merchants can use their brand …

Read More »Study: Peer-to-Peer Payments Are Key To Financial Institutions’ Payment Strategies

As financial institutions look to revamp their payment strategies, peer-to-peer payments are expected to play a key role, says a report from Cornerstone Advisors. During the past three years, nearly 30% of community-based financial institutions have replaced their P2P service or selected a new one, and about one in five …

Read More »CFPB Fines Wells $3.7 Billion And Other Digital Transactions News briefs from 12/20/22

The Consumer Financial Protection Bureau has ordered Wells Fargo Bank to pay $3.7 billion, including a $1.7-billon civil penalty and $2 billion in redress to consumers, for what the bureau says were illegal fees and interest charges on auto and mortgage loans, incorrect charges on checking and savings accounts, and other “incorrect” …

Read More »Zelle Users Are More Profitable for Financial Institutions, says an Early Warning Study

Customers new to using Zelle, the peer-to-peer payment network operated by Early Warning Services LLC, have higher levels of engagement with their financial institutions than customers not using Zelle. That’s according to a recent study conducted by Early Warning and Curinos, a provider of data and technology technologies to financial …

Read More »