Some 81% of U.S. consumers have used a one-click payment method while shopping online, with 37% using the method “frequently,” according to a survey earlier this month of 961 consumers by The Strawhecker Group and the Electronic Transactions Association.Switched dollar volume and switched transaction volume for Mastercard Inc. in the week ending Nov. 21 were both …

Read More »Search Results for: retail

COMMENTARY: Three Things C-Stores Must Do Now to Contend With Covid-19

The pandemic has forced the world—individuals and businesses alike—to reassess their approaches toward life and reevaluate daily processes. The same goes for convenience stores with a particular focus on solution-driven innovation and adaptation. They must evolve their businesses with modern technologies, such as contactless payment processing, pre-store visit staging, and …

Read More »ATM Operators Praise a Proposed OCC Rule That Would Wipe Away Years-Old Regulatory Roadblocks

Independent ATM operators are lauding a proposed rulemaking from the federal Office of the Comptroller of the Currency they say would correct a history of denial of access to banking services for entrepreneurs that install and operate ATMs in retail stores and other locations. Observers say the rulemaking, if adopted, …

Read More »Gateways Adapt to E-Commerce As They Contend With Covid-19’s Impact

The Strawhecker Group’s most recent analysis of 100 payment gateways found that half of them charge a monthly fee, down from 74% in 2019. That is potentially because of the impact of the Covid-19 pandemic, the report says. Other findings show that 52% of all gateways focus on retail, followed …

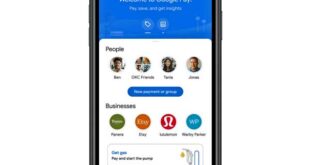

Read More »A Revamped Google Pay Seeks Wider Appeal by Pushing Beyond Payments

Alphabet Inc.’s Google unit on Wednesday announced a major overhaul of its 5-year-old Google Pay wallet to push beyond mobile payments and incorporate links and data Google says will generate daily usage. The move comes as major payment apps such as Apple Pay and Google Pay have sought to boost …

Read More »Eye on BNPL: Klarna Adds 1 Million Customers in 3 Weeks And Affirm Readies an IPO

Consumers appear to be flocking to buy now, pay later options. Evidence of that comes from Klarna US, which says it gained 1 million customers in three weeks, pushing its total to 11 million. It has grown from 9 million customers only since August. Among the reasons for the rapid …

Read More »CardFlight Adds 20,000 Merchants and other Digital Transactions News Briefs from 11/18/20

Point-of-sale technology provider CardFlight Inc. said more than 20,000 new merchants so far this year have installed the company’s SwipeSimple software, bringing the total to 70,000. The technology lets merchants accept mobile as well as in-store payments.Square Inc. released Square KDS, software that displays restaurant order tickets from various points of origin, including point of …

Read More »Chase Adds BNPL Option and other Digital Transactions New briefs from 11/16/20

JPMorgan Chase & Co. is the latest to join the buy now, pay later trend with “My Chase Plan,” which allows holders of Chase consumer credit cards to pay off purchases over time with no interest. A monthly fee applies.Debit card use in mobile wallets soared 58.6% for the week ending …

Read More »A New Virus Surge Will Send E-Commerce Volume Soaring Even Beyond Current Levels

With a second wave of the Covid-19 pandemic surging and bringing with it the fear of another nationwide lockdown, merchants can expect to see a minimum 20% to 30% increase in holiday e-commerce sales in 2020, compared to 2019, says ACI Worldwide Inc. The Naples, Fla.-based payments provider Thursday said …

Read More »InComm Teams With MoCaFi to Offer Free Reloads to Unbanked Prepaid Card Users

Payment technology provider InComm Payments is partnering with Mobility Capital Finance (MoCaFi), a mobile-based banking platform, to enable MoCaFi Mobility Debit Mastercard cardholders to load their cards at no charge. MoCaFi will absorb any costs related to the reload. The deal enables MoCaFi, which serves unbanked and underbanked customers, to offer …

Read More »