Payments provider Nuvei Corp. announced an integration with Block Inc.’s Cash App, allowing Nuvei merchants to more easily adopt Cash App Pay for online checkouts. Worldpay LLC announced it is now operating as an independent company following the close of an $18.5-billion transaction that saw private-equity firm GTCR acquire 55% of its equity, …

Read More »Search Results for: worldpay

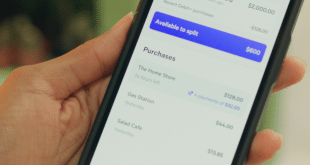

Eye On BNPL: Affirm Teams Up With Blackhawk Network; Splitit Delists Upon Its Latest Cash Infusion

BNPL providers are expanding the utility of the payment option by enabling consumers to finance gift card purchases. BNPL provider Affirm Holdings Inc. announced Tuesday it is partnering with prepaid card platform provider Blackhawk Network Holdings Inc. to allow consumers to purchase digital gift cards on Affirm.com or in the …

Read More »Payment Apps Are Making Steady Strides With Consumers, an ETA/TSG Study Shows

Roughly a decade after Apple Pay and other digital wallets burst into the U.S. payments market, the apps seem to be well on their way toward mass adoption, according to consumer-survey results released early Wednesday by the Electronic Transactions Association and the consulting and research firm TSG. In line with …

Read More »Worldline is Partly to Blame for Its Stock’s Sudden Collapse

Like a thunderclap, on Oct. 25 the stock price of continental Europe’s biggest payment processor, Worldline, plummeted 59%. It’s down a whopping 88% from its high in April 2021. Macroeconomic conditions are to blame, but so are Worldline-specific factors. The reign of easy money is over. Easy money inflates valuations. …

Read More »J.P. Morgan Debuts Pay-by-Bank And Other Digital Transactions News briefs from 10/20/23

J.P. Morgan Payments launched its pay-by-bank service, relying on open-banking technology from Mastercard Inc. The service lets customers pay bills directly from their bank accounts. Block Inc.’s Afterpay buy now, pay later platform announced a partnership with Nift Networks to offer users access to products and services offered by Nift. Point-of-sale system maker Revel …

Read More »Health iPASS’s New Service And Other Digital Transactions News briefs from 10/18/23

Health iPASS launched Health iPASS Cloud Payments, a processing service for health-care providers. Fiserv Inc. said it is leveraging its merchant-acceptance and card-issuing technology to ease embedded finance for client financial institutions. Metropolitan Commercial Bank said it will deploy cloud-based technology from Finzly to support payment processing via FedNow, Fedwire, and the automated …

Read More »Nacha Volume up 20% And Other Digital Transactions News briefs from 10/17/23

Nacha, the governing body for the automated clearing house network, reported the system processed 212 million same-day payments worth $608 billion in the September quarter, up 20% and 27.1%, respectively, over the same period last year. Total volume for all ACH payment types for the quarter came to 7.8 billion, …

Read More »Zebra Joins the Race for Mobile POS Market Share

Zebra Technologies Corp. has entered the highly competitive mobile-payments market with the introduction of Zebra Pay, a software-based, PIN entry, consumer off-the-shelf mobile payment solution for merchants. With solutions like Zebra Pay, the cardholder’s PIN is entered on an acquirer’s app running on the mobile device, while the card is …

Read More »Visa Moves Blockchain Into Acquiring With a Pilot for Merchant Processors

Visa Inc., which has been working with blockchain-based currencies at least since the start of the decade, on Monday said it is starting to expand its cryptocurrency services into merchant acquiring, largely for cross-border transactions. The move, which Visa calls a “pilot project,” involves the major merchant processors Worldpay and …

Read More »BNPL’s Rapid Ascent Evokes Clashing Opinions on the Ethics of Short-Term POS Credit

The buy now, pay later craze, which took flight during the Covid pandemic, has turned into a $70-billion-plus segment of the payments industry. But that doesn’t mean it hasn’t stirred controversy among acquiring-industry executives, some of whom manage versions of the point-of-sale credit product. That clash of viewpoints emerged Wednesday …

Read More »