Acquirers are starting to leverage the power of massive—and diverse—pools of information. The challenge lies in unlocking big data’s full potential. Big data has been a hot topic for years as companies look for innovative ways to become more competitive, boost customer retention, and raise their bottom line. Now merchant …

Read More »Search Results for: banking

Interesting Times

With Republicans now in full control of Washington, big changes could be in the offing for laws and regulations affecting electronic payments. But then again, maybe not. Some say he’s a nominal one, but incoming President Donald Trump officially is a Republican, and when he’s inaugurated Jan. 20 he’ll be …

Read More »The Age of Bots

They sell products, answer questions, and take payments in a process called conversational commerce. Just how much potential do chatbots really have? It’s been one of those days. You could use a drink. But you’re traveling on business, and you’re not sure where the local bars are. And you’re not …

Read More »PayPal Follows Up on Visa And MasterCard Pacts With Citi And FIS Agreements for 2017

After PayPal Holdings Inc. in July signed a sweeping agreement with Visa Inc., and in September reached a similar deal with MasterCard Inc., giving PayPal access to the card networks’ token engines and thereby new access to the physical point of sale, observers wondered when the other shoe would drop. It dropped …

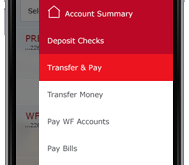

Read More »Bill Pay, Mobile Deposit Among the Most Popular Features of Banks’ Mobile Apps

Bill payment continues to reign as the most-used payments feature of banks’ mobile apps, but mobile deposit and person-to-person payments are coming on strong, according to new findings from research firm Celent and FI Navigator Corp. The “Mobile Banking Quantified” study by Celent, a division of New York City-based of Oliver …

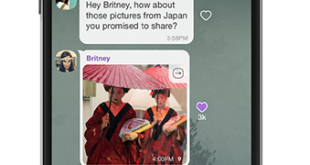

Read More »Messaging-Based Payments Heat Up As Western Union Expands Its Link to Viber

The merger of messaging apps and payments took another step forward Wednesday with the news that The Western Union Co. is allowing U.K. users of the popular Viber service to send money from within the app. The deal follows a similar arrangement the money-transfer kingpin made with Viber for U.S. …

Read More »Image Exchange Leader ECCHO Exploring ‘Possible Strategic Opportunities’

The Electronic Check Clearing House Organization (ECCHO), a leader in the movement to develop check image exchange, announced Monday that it is “exploring possible strategic opportunities.” The terms “exploring strategic opportunities” or “exploring strategic options” usually mean a company is up for sale. It is indeed possible that the ECCHO …

Read More »How Chatbots Are Starting to Mine Payments Potential for Banks, Issuers, And Chat Apps

It may be called artificial intelligence, but the potential this technology opens up for payments and banking is turning out to be very real. Earlier this week, yet another major messaging platform agreed to support chatbots that would let its users transfer funds, check their bank balances, and perform other …

Read More »COMMENTARY: Why You Shouldn’t Count on Real-Time ACH for Retail Payments

A demand-deposit account is the anchor liquidity instrument for most consumers and businesses. For some members of the unbanked, it’s a GPR-prepaid-card account. Policymakers and commercial actors are moving to enable real-time payments between DDAs at thousands of U.S. banks. Policymakers aim to improve payment-system efficiency and enable new and …

Read More »The Feds Plan To Create a National Bank Charter for Fintech Companies

The U.S. Treasury Dept.’s Office of the Comptroller of the Currency, which regulates national banks, plans to create a special-purpose national bank charter for financial technology companies, a booming field in which payments firms play prominent roles. Comptroller of the Currency Thomas J. Curry divulged the planned charter during a speech Friday at …

Read More »