The Huntington National Bank launched a secured credit card offering 1% cashback rewards and no annual fee. Secured cards require cardholders to make a one-time, refundable deposit to back activity on the card. Mastercard Inc. and BOK Financial Corp. expanded their agreement making Mastercard the exclusive payments network in BOK’s debit and …

Read More »Search Results for: card data

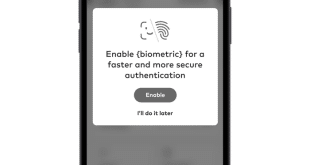

Mastercard Tags Biometrics And Passkeys as a Fix for Passwords

Mastercard Inc. is taking on the problematic use of passwords with its new Biometric Authentication Service. Announced Wednesday, the new global service is meant to help resolve friction and vulnerability issues that arise from ceaseless passwords and multi-factor authentication prompts, Mastercard says. The service relies on standards from the Fast …

Read More »GoCardless Picks Up JustGiving And Other Digital Transactions News briefs from 1-9-24

GoCardless said it will process open-banking payments made on JustGiving, an online donation platform, replacing American Express Co. FirstOntario Credit Union said it is preparing to launch open banking through connections to Everlink Payment Services Inc. and open-banking technology platform Flinks. The federal government in Canada said in November it planned to …

Read More »Holiday Sales on Cards Are Off to a Healthy Start, the NRF Says

Holiday sales were robust in November, giving merchants reason to be optimistic about overall spending for the holiday shopping season, according to the National Retail Federation. Total retail sales in November, excluding automobiles and gasoline, rose 0.77% month-over-month on a seasonally adjusted basis, and 4.24% on an unadjusted basis year-over-year, …

Read More »How DataVisor Is Harnessing SMS Technology to Combat Fraud From Identity Theft

Short-message service, or SMS, is coming to the aid of fraud managers looking to verify the identity of persons on the receiving end of payments transactions. The technology, which undergirds the well-known texting function between users of mobile phones, can be harnessed to stop fraud, according to security firm DataVisor …

Read More »Priority Cements Datacap Integration And Other Digital Transactions News briefs from 11/30/23

Priority Technology Holdings Inc. said its MX Merchant Suite software will integrate a platform from payments-technology provider Datacap. Mastercard Inc.’s Dynamic Yield technology unit launched a generative AI (artificial intelligence) tool that is aimed at helping consumers search for products in a merchant’s digital catalog. Authvia, a provider of tokenized pay-by-text technology, …

Read More »Eye on Mastercard: Bankcard Clearing in China; a Partnership With Feedzai to Attack Crypto Risk

The People’s Bank of China and the National Administration of Financial Regulation, China’s financial regulatory body, on Monday greenlighted Mastercard Inc.’s joint venture, Mastercard NUCC Information Technology (Beijing) Co. Ltd, to commence domestic bankcard clearing in China. The approval process took about three years. In February 2020, China’s central bank …

Read More »A New Merchant Group Voices Opposition to a Bill Aimed at Credit Card Acceptance Costs

The political battle over the Credit Card Competition Act has heated up as the Small Business Payments Alliance (SBPA), a recently formed merchant trade group, has come out in opposition to the proposed legislation. The group argues that, if passed, the CCCA would harm small businesses. The SBPA, which held …

Read More »The CFPB Reports on Rising Credit Card Late Fees And Rates—And Vows To Lower Them

Last year, credit card issuers charged consumers more than $105 billion in interest and more than $25 billion in fees, $14.5 billion of which came from late fees, according to the Consumer Financial Protection Bureau’s biennial credit card market report. Credit card holders paid about 20% of their average balance …

Read More »The Fed’s Debit Card Interchange Proposal Isn’t Pleasing Merchants Or Issuers

The Federal Reserve Board’s proposal Wednesday to make a 31% reduction in the main component of its debit card interchange ceiling for large issuers touches on a longstanding sore point among merchants and has already sparked a spirited debate in the payments industry. Merchant groups, long riled by debit card …

Read More »