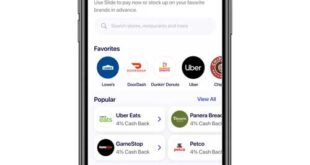

Responding to consumer demand for an easier way to shop and earn rewards online, Raise Marketplace LLC announced Thursday the launch of an in-app shopping feature for its Slide mobile app. Consumers can now connect directly through the Slide app to the company’s more than 200 merchant partners to shop, …

Read More »Search Results for: inflation

Prices Are Booming for Stolen Credit Card And Cryptocurrency Accounts

Prices for cloned credit cards and the accompanying account data for sale on the dark Web are on the rise, while data from hacked cryptocurrency accounts command some of the highest prices, according to a report from PrivacyAffairs.com, an online publication from Romania-based Zisk Web Ltd. From October 2020 through February …

Read More »COMMENTARY: With Digital Currency, Regulators Should Let Markets Pick Winners

Launched in 1989, Digicash introduced the first cryptocurrency. In the 1990s, it was considered leading-edge payments technology. But physical and digital currencies are payment networks. In payment systems, good technology is neither sufficient nor generally the biggest hurdle. No matter how good the technology, without critical mass they’re worth little. …

Read More »Bitcoin’s Notorious Volatility Clouds Optimism As the Digital Currency Zooms Past $40,000

One week into the new year, Bitcoin’s dizzying rise is prompting questions about what’s fueling it and how long it can go on before yet another crash. One factor, as it turns out, could be greater clarity concerning Bitcoin’s potential to enter the mainstream of retail payments after a dozen …

Read More »Libra Yes. Bitcoin No

Bitcoin has floundered because it serves no real need. The story with Libra is far different. While Bitcoin and Libra are both currencies and payment systems, their potentials are vastly different. From its inception, Bitcoin evangelists enthused it would upend reigning fiat currencies and electronic-payment systems. A high-octane cocktail of …

Read More »Merchants’ Double Whammy

Merchants have been skirmishing with networks and issuers over acceptance costs since the days of cardboard cards. As 2020 approaches, interchange rates are stable, but merchants are seeing more sales on high-cost rewards cards while paying more network fees. Not so long ago, if you wanted to get a card-accepting …

Read More »COMMENTARY: Here’s Why the Fed Should Stay Out of Real-Time Payments (Part II)

Tech behemoths Google, Amazon, and Apple, goliath retailers Walmart and Target, and PayPal, all support the Federal Reserve providing faster payments via its FedNow service, slated for introduction by 2024. Each of them, however, would howl in protest if Washington proposed competing with their business or helping would-be competitors. Fearing The Clearing …

Read More »The Tech Imperative

When news broke in mid-January that Fiserv Inc. had offered to buy First Data Corp. in an all-stock transaction, we knew instantly we had our cover story. The trouble was, our February issue was already buttoned up, so we knew we’d have to wait for March. As often happens, this …

Read More »Growth in Remote Card Payments Far Outpaces Point-of-Sale Payment Growth, the Fed Reports

E-commerce, online bill payments, and other forms of card-not-present payments continued their strong growth last year to capture a bigger share of total card payments, according to newly released Federal Reserve data. The number of what the Fed calls remote payments using general-purpose payment cards grew 22.8% in 2017 from …

Read More »The Fraud Scourge Lessens for Debit Card Issuers

Debit card fraud rates fell last year, according to a widely watched annual study of the U.S. debit market. The study also provides new insights about debit cards and mobile wallets, and debit’s increasing popularity for small purchases. The fraud-loss rate for non-PIN (mostly signature-debit) transactions fell 30% from 2.6 …

Read More »