Despite predictions that buy now, pay later loans will account for $680 billion in transactions by 2025, or about 12% of all e-commerce sales, the industry remains on a potential slippery slope when it comes to consumer protections, says a paper issued Monday by the Mossavar-Rahmani Center for Business and Government at …

Read More »Search Results for: BNPL

Zero Interest Is Key BNPL Driver; Data Breaches Soar, a Third Time; Another FI Picks Zelle

The Absence of Interest Charges Is What Tweaks Consumer Interest in BNPL Services

The buy now, pay later trend continues to solidify into a permanent part of the payments arena, thanks to consumers who readily adopt the installment-payment service. Now, new research finds that many—82%—are drawn to it because they do not have to pay interest for the installment-payment benefit. New research from …

Read More »The Risks of Not Offering BNPL; Century Bank Picks Priority’s Payables Platform; Wyre’s Sale Terms Inaccurate

There’s More to Lose in Not Offering BNPL Than in Offering It, Providers Warn

The buy now, pay later trend may have come under scrutiny lately by regulators, but companies enabling BNPL warn sellers and payments providers risk losing merchant volume and younger consumers if they don’t offer the installment option online and at the point of sale. “You’ll see volume attrition without merchant …

Read More »PayRange Adds Crypto, BNPL Vending Options; PCI DSS 4 Takes on Emerging Issues; Paysafe Bets on Ontario

Crypto, Gift Cards, And Even BNPL Come to Unattended Payments Via PayRange

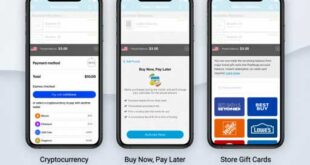

Transactions on gift cards and cryptocurrency—and even buy now, pay later capability—are coming to commercial washers, dryers, and vending machines with an announcement Monday by PayRange Inc. that it will support the new payment methods. The Portland, Ore.-based company, which says it processes for more than half a million commercial …

Read More »Payments 3.0: How EWA And BNPL Could Help End Poverty

Buy now, pay later and earned-wage access services could be powerful tools to end poverty, if they are not regulated out of existence. Both of these products directly address one of the main factors causing poverty: income volatility. In “The Financial Diaries: How American Families Cope in a World of …

Read More »Virgin Atlantic Onboard with CellPoint Digital; Expect More BNPL Use; Payapa in Cross-Border Payments Play

A Sezzle Survey Says Consumers Expect To Make Even Greater Use Of BNPL This Year

Two years after the Covid-19 pandemic helped make buy now, pay later loans popular with online shoppers, BNPL remains a highly attractive payment option, according to a study by BNPL provider Sezzle Inc. Of the 1,153 online shoppers surveyed by Sezzle, 60% of BNPL users plan to use BNPL more …

Read More »