Steven Velasquez, Senior Vice President and Head of Partner Business Development – Elavon As the worlds of technology and financial services converge, providing your merchants and their end users with a connected buying experience is crucial to differentiating your software in an increasingly crowded and competitive market. ISVs are now …

Read More »Search Results for: card data

Paya Partners With 1Retail to Bring Integrated Payments to Small Businesses

Payments provider Paya Inc. has agreed to supply point-of-sale systems supplier 1Retail with technology that enables EMV contactless and stored payments in enterprise resource planning (ERP) software from Acumatica Cloud. The deal provides Paya’s and 1Retail’s mutual customers running the Acumatica ERP platform with a POS system that works in …

Read More »Fraud on P2P Networks Hits 12% of Bank Customers in the U.S., J.D. Power Finds

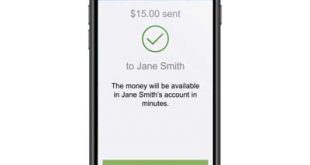

Some 12% of U.S. customers have lost money to fraud on a peer-to-peer payment network, while 11% have seen it happen to a family member, according to survey results released earlier this month by J.D. Power. The networks cited by the respondents were Zelle, Venmo, and PayPal. For the survey, …

Read More »Study: Peer-to-Peer Payments Are Key To Financial Institutions’ Payment Strategies

As financial institutions look to revamp their payment strategies, peer-to-peer payments are expected to play a key role, says a report from Cornerstone Advisors. During the past three years, nearly 30% of community-based financial institutions have replaced their P2P service or selected a new one, and about one in five …

Read More »Zelle Users Are More Profitable for Financial Institutions, says an Early Warning Study

Customers new to using Zelle, the peer-to-peer payment network operated by Early Warning Services LLC, have higher levels of engagement with their financial institutions than customers not using Zelle. That’s according to a recent study conducted by Early Warning and Curinos, a provider of data and technology technologies to financial …

Read More »COMMENTARY: Apple Pay Later Is Set to Trigger a Domino Effect in the BNPL World

The interest in buy now, pay later (BNPL) skyrocketed in 2021 and 2022: Millions of people have turned to this installment-payment solution for its convenience, flexibility, and simplicity. So it’s no surprise that Apple announced its new BNPL product, Apple Pay Later, in June. With its new financial service, the …

Read More »No Slowdown for Record-Breaking Phishing Attacks

Phishing attacks continue to set record highs. The third quarter of 2022 was the highest quarter on record for number of attacks, according to the latest Anti-Phishing Working Group’s Phishing Activity Trends report, released Wednesday. The APWG observed 1,270,883 phishing attacks during the September quarter, up 16% from a then-record …

Read More »Eye on Cannabis: Merrco Brings BNPL to Cannabis Sellers; Aeropay Partners with HighHello

Toronto-based Merrco Payments Inc., which specializes in cannabis-payments processing, is partnering with buy now, pay later provider Gratify Payments Inc. to enable cannabis merchants in Canada to offer BNPL loans as a payment option. Offering the installment payments is expected to help Canadian cannabis merchants upsell customers on accessories and …

Read More »COMMENTARY: How Banks And Credit Unions Can Create a Top of Wallet Experience for Consumers

As the holiday season continues and the cost-of-living rises, shoppers are searching for meaningful yet budget-friendly gifts for loved ones. Consumers need financial flexibility to make large purchases without using their entire paycheck to do so. Buy now, pay later solutions continue to rise in popularity as consumers search for …

Read More »Limited U.S. Growth in 2023 And Other Digital Transactions News briefs from 12/8/22

Not all countries, companies, and persons will suffer equally from inflation in 2023, as Europe will see a decline in economic activity while the U.S. market will experience limited economic growth, forecasts the Mastercard Economics Institute. Food-service provider Sodexo North America’s InReach unit has contracted with payments provider Cantaloupe to upgrade 18,800 vending machiens and …

Read More »