MiCamp Solutions said it increased its investment and involvement with Cocard, a unique owner-operated independent sales organization. Terms were not disclosed, though MiCamp said collectively the alliance will serve more than 46,000 merchants and process more than $40 billion in annual transaction volume. Payments provider Nuvei Corp. has agreed to process online transactions …

Read More »Search Results for: pay by bank

Claims Process Begins in Interchange Lawsuit And Other Digital Transactions News briefs from 12/1/23

The claims process begins today for merchants to file for a share of the $5.54-billion settlement of a massive lawsuit originally filed more than a decade ago that alleged that Visa, Mastercard, and banks had violated antitrust laws in setting fees for card acceptance. The number of merchants involved is expected to …

Read More »Who Will Fill in for Visa And Mastercard?

Ever since U.S. Senators Dick Durbin of Illinois and Roger Marshall of Kansas introduced the Credit Card Competition Act last year, we haven’t been surprised at the bipartisan support the legislation has received. After all, the bill promises to contain credit card acceptance costs for merchants, and to do it …

Read More »A Reckoning on Wall Street

The payments market is enjoying more vitality and growth than most can remember. So what’s behind the recent market rout? The payments market is enormous and growing. Capgemini forecasts a 15% compound annual growth rate for global noncash digital payments through 2027. The Boston Consulting Group estimates global acquiring revenue …

Read More »Acquirers Seek Answers from a Visa Surcharging Executive

More than 10 years after Visa Inc. wrote its rules permitting surcharging on its credit cards, questions remain among acquirers, especially those selling or considering surcharge programs for their merchants. Now, as more merchants mull surcharge or cash-discount programs to alleviate some of their card-acceptance costs, and with recent changes …

Read More »Implementing FedNow: Four Considerations

It will take some time and effort, but with proper planning and research financial institutions can minimize the hassles. Many people in banking and financial technology aren’t aware that the word “core” in “core banking provider” started out as an acronym for “Centralized Online Real-time Exchange” (or “Environment”). This “real-time” …

Read More »Fixing the Online Checkout

E-commerce checkouts are still too clunky. Now, efforts by payments experts and at least one new network may at last solve that problem. In the battle for the e-commerce checkout—with a successful sale counting as a win—the accelerated checkout is gaining favor. One contender that’s not even available yet may …

Read More »Cutting Fraud Down to Size

These days, fighting bad actors without automation is worse than useless. It’s dangerous to the bottom line. Automation is often thought of as a threat to humans’ jobs. I’d argue that mindset is very limiting. Technology and humans are complementary. Automation is here to enhance human actions and increase their …

Read More »Who’s Afraid of SoftPOS?

The technology is building momentum as merchants of all sizes displace POS terminals with commercial off-the-shelf devices. There are some issues. It wasn’t all that long ago that the idea of turning an ordinary smart phone into a point-of-sale terminal seemed like a pipe dream. But more than a decade …

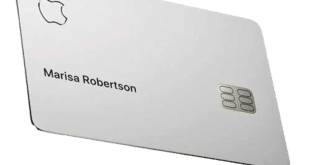

Read More »Apple May Be Looking to Replace Goldman, But Will Any Issuer Want the Apple Card?

Apple Inc. may be looking for a new bank to issue its Apple Card, but the big question is whether any potential candidate will want to take it on, some observers say. Apple is apparently taking the initiative in finding a replacement for Goldman Sachs Group, which has issued Apple’s …

Read More »