Paze, the online checkout service from Early Warning Services LLC, says consumers that belong to the Sephora loyalty program can now use it to pay for transactions on the retailer’s Web site. Backed by some of the nation’s largest banks, Paze is an expedited checkout service that includes addresses and …

Read More »Search Results for: passwords

The Dawn of the Digital Payment Identity

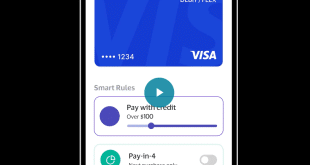

In the Visa Flexible Credential, has the payments industry found its ultimately secure identity solution? New ways to use technology, changing consumer preferences, and comfort with digital payments may all be fostering the first steps toward a digital-payment identity. But is it time for a digital-payment identity? Visa must think …

Read More »BNPL Finds Favor Among Consumers Amid Rising Prices

Buy now, pay later, the now established installment-payment option, is finding favor among consumers facing higher prices. That’s the word from a new report from Forter, an online fraud-prevention provider, based on its latest survey. Twenty-five percent of the 2,000 U.S. consumers surveyed by Talker Research say they use BNPL …

Read More »The U.S. Payments Forum Looks to Multi-Factor Authentication to Fight Phishing

As criminals’ knowledge of how to beat multi-factor authentication through phishing schemes increases, the need for payment providers to implement phishing-resistant solutions continues to grow. Phishing attacks are a form of social engineering in which cybercriminals deceive consumers into revealing personal and account information. The cybercrime can also involve installation …

Read More »Visa Revamps its Payments Approach

Visa Inc. is taking up the notion of a digital payment identity and making it part of its product mix. Announced Wednesday at the Visa Payments Forum in San Francisco, the Visa Flexible Credential is but one of several products the payments network formally debuted, including broader tap-to-pay capabilities, a …

Read More »Data Breaches Continue to Explode, Increasing 90% in the First Quarter

The number of publicly reported data breaches nearly doubled during the first quarter compared to the same period a year ago, according to the Identity Theft Resource Center’s quarterly report, issued Tuesday. The ITRC tracked 841 publicly reported data breaches during the first quarter, up from 442 during the same …

Read More »Consumer Fraud Recovery Costs Rocket 70% in One Year

Rising costs aren’t just happening in grocery stores. They have caught up to fraud-recovery costs when consumers work to untangle the mess caused by identity theft and scams. The average out-of-pocket expense for a consumer in that situation ballooned 70% from $119 in 2022 to $202 in 2023, according to …

Read More »Get Set for the Passage to Passkeys

The technology promises to thwart cyberthieves while simplifying authentication for consumers. In the ever-evolving landscape of online transactions, the banking and transaction experience is undergoing transformative shifts, focusing on regulatory compliance and fraud reduction, while creating optimal experiences for merchants and their customers. As the United States is the second-largest …

Read More »First-Party Fraud Continues to Bedevil Merchants, Mastercard Says

Chargebacks are always an issue for merchants. While there are numerous programs and indicators to identify fraudulent ones, detecting and managing first-party fraud—that committed by legitimate customers—can be tougher to root out. In response, Mastercard Inc. is pushing its First Party Trust Program, an artificial intelligence-based service that enables merchants …

Read More »Radial Adds Link Money’s Pay by Bank for Account-to-Account Payments

E-commerce platform Radial Inc. is giving its merchants a new payment option that bypasses traditional credit and debit card payments and instead relies on account-to-account transfers. Dubbed Pay by Bank, the service was developed by Link Financial Technologies Inc., which does business as Link Money, an open-banking platform. King of …

Read More »