While rewards are the biggest reason consumers choose a credit card, cardholders believe issuers have more room for improvement when developing rewards programs, especially when it comes to personalization, according to Marqeta Inc.’s 2023 State of Credit report. The report reveals that 58% of consumers surveyed cited rewards as the …

Read More »Search Results for: pay by bank

Visa’s AR Manager And Other Digital Transactions News briefs from 10/23/23

Visa Inc. announced it will start a pilot in November for Visa AR Manager, a platform intended to automate more functions in commercial card acceptance. PayNearMe, a specialist in payments for iGaming and sports betting, will add to its MoneyLine platform the “Cardless Cash at ATM” feature from NCR Atleos Corp. …

Read More »Discover Looks to a Resolution of Regulatory And Merchant Pricing Snafus

The top management at Discover Financial Inc. said early Thursday its issues with regulatory compliance and merchant overcharges continue to cast a shadow over the company but could be on the way to being solved. The problems, which included misclassification of merchants resulting in overcharges for card acceptance, came to …

Read More »BNPL Is Broadening Its Audience To Include Financially Strong Borrowers, J.D. Power Finds

The audience for buy now, pay later loans is widening to include financially healthy consumers who don’t need the extended buying power BNPL loans provide. The reason, according to a report citing J.D. Power’s 2023 BNPL Satisfaction Study, released in August, is reasonable repayment terms. While some 28% of U.S. …

Read More »The Federal Reserve Is Set to Revisit the Debit Fee Cap

The Federal Reserve Board of Governors will consider revisions to its cap on debit card swipe fees at its meeting next Wednesday. The announcement was made as part of a public notice about the upcoming board meeting. While no further details were provided about the Fed’s intentions, retailers made it …

Read More »Health iPASS’s New Service And Other Digital Transactions News briefs from 10/18/23

Health iPASS launched Health iPASS Cloud Payments, a processing service for health-care providers. Fiserv Inc. said it is leveraging its merchant-acceptance and card-issuing technology to ease embedded finance for client financial institutions. Metropolitan Commercial Bank said it will deploy cloud-based technology from Finzly to support payment processing via FedNow, Fedwire, and the automated …

Read More »Nacha Volume up 20% And Other Digital Transactions News briefs from 10/17/23

Nacha, the governing body for the automated clearing house network, reported the system processed 212 million same-day payments worth $608 billion in the September quarter, up 20% and 27.1%, respectively, over the same period last year. Total volume for all ACH payment types for the quarter came to 7.8 billion, …

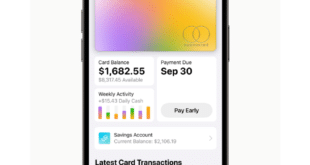

Read More »Goldman Faces Some Hard Decisions As It Confronts Its Position in Consumer Credit Cards

The pressure at Goldman Sachs Group Inc. to exit, or at least radically modify, its consumer-credit and payments businesses appears to be mounting. At least some executives at the company are pushing senior management to exit credit card deals with Apple Inc. and General Motors Corp., The Wall Street Journal …

Read More »How NMI’s Deal for Sphere’s Commercial Division Will Ease New Merchant Accounts

Payments provider NMI LLC announced Thursday it has acquired the commercial division of Sphere, a cloud-based software and payments-technology company. Sphere Commercial Division primarily serves non-integrated small and mid-size businesses. Terms of the deal were not disclosed. Schaumburg, Ill.-based NMI says the acquisition will strengthen its underwriting and risk-management capabilities …

Read More »

COMMENTARY: A Dose of Reality on the Broken Credit Card Market

Eric Cohen’s Commentary, “Whey the Credit Card Competition Act Falls Short,” posted here Oct. 9, makes three key claims about how the Credit Card Competition Act would supposedly harm small businesses and consumers. All of them are wrong.First, he says the bill would allow merchants “to choose their own network” …

Read More »