The Fed’s new real-time payments platform will pose challenges for risk management. Here’s how to cope with that. The U.S. Federal Reserve made its FedNow instant-payments service live in July. It enables a faster flow of cash for companies and individuals, improving the overall flow of money through the U.S. …

Read More »Search Results for: pay by bank

What’s next for FedNow?

Now that FedNow is available, the real work begins. But will the new system compete or collaborate with existing real-time networks? FedNow, the real-time payments service from the Federal Reserve, launched with 35 participating institutions on July 20, almost 13 years after the Fed’s same-day automated clearing house settlement window …

Read More »The Next (R)evolution in Embedded Services

Here’s why more merchants and service providers are starting to embrace embedded finance. This year marks the 25th anniversary of PayPal. While e-commerce existed in some form as early as 1979 (once any new technology arises, it’s not long before someone monetizes it), PayPal changed the game for small- and …

Read More »The CCCA—What’s Not to Like?

Credit card interchange has come under assault, and not for the first time. Now, though, the stakes are higher than ever. The cleverly crafted “Credit Card Competition Act of 2023” from Sens. Durbin, Marshall, Welch, and Vance is the latest salvo in a forever war against payments-industry fees, including how …

Read More »Security Notes: The Cyber Ocean And the Chemistry Beach

There are many ways to protect against a shark attack: certain wet suits, defensive tools, evasive behavior, and so on. Sometimes they help, other times they don’t. What never fails is to walk on the beach. Safety guaranteed. Same for the cyber ocean. If you walk on its beach, known …

Read More »Are They Coming for BNPL?

The buy now, pay later craze, which took flight during the Covid pandemic, has turned into a $70-billion-plus segment of the payments industry. But that doesn’t mean the point-of-sale credit product hasn’t stirred controversy among acquiring-industry executives—mirroring, in fact, the diverging opinions held by business observers and regulators generally. We …

Read More »TNS Lines up 1,500 ATMs Contract And Other Digital Transactions News briefs from 8/29/23

U.S.-based network-management company Transaction Network Services said its technology will manage connectivity for Spain-based Euro Automatic Cash, a network of 1,500 ATMs. Tiptap, a donation platform, said it will enable Visa member financial institutions to offer customers a platform to make small donations to community charities while they are performing routine banking …

Read More »Visa Alters Chargeback Rules And Other Digital Transactions News briefs from 9/28/23

Visa Inc. says a change to its dispute rules and processes will make it easier for merchants to fight so-called friendly fraud in card-not-present transactions. With such fraud, cardholders dispute legitimate transactions to claim a refund. Payments provider Deluxe Corp. will offer bill-payment technology from Aliaswire Inc. to its banking clients through a new …

Read More »ACI’s Real-Time Microsoft Deal And Other Digital Transactions News briefs from 9/19/23

ACI Worldwide Inc. said it will work with Microsoft Corp. to make its Real-Time Payments Cloud available in Microsoft Azure, enabling financial institutions access to The Clearing House Payments Co. LLC’s Real Time Payments network and the Federal Reserve’s FedNow real-time payments service. Treasury Prime, an embedded-banking technology provider, said it …

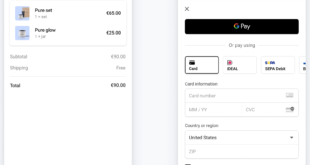

Read More »Stripe Eyes Its Checkouts for Consumers And Conversions for Merchants

Stripe Inc. early Monday launched a series of enhancements aimed at improving checkouts for merchants. The new features—which include one-click checkouts and a no-code A/B testing tool for businesses to evaluate how different payment methods perform—rely on pre-built user interfaces. This should allow merchants to quickly deploy the new features, …

Read More »