The buy button, which only two years ago showed much promise on social networks, has been superseded by the need to accommodate mobile shoppers. They were once thought to be a new way to spur more online transactions as consumers amped up the time they spent on social networks. But, …

Read More »Search Results for: card data

Alive And Starting To Kick

As they rapidly evolve, biometric technologies are certain to play a greater role in payment authentication. But, given consumer acceptance and other issues, just how big this role will be is up for debate. With most new developments in payments, there’s a whole lot of talk before any discernible action. …

Read More »There’s an App for That

You know companies like PayPal, Shopify, and Square as high-tech payment processors. Lately, they’ve applied that technology to the established business of merchant cash advances, with promising results. Long the mainstays of the merchant cash-advance business, alternative lenders are facing competition from a new breed of players—tech companies with street …

Read More »Veem Makes Cross-Border QuickBooks Integration and other Digital Transactions News briefs

Discover Financial Services said it has enabled Samsung Pay on the latest Samsung Galaxy smart phones and wearables for its cards in the United States. Discover announced in 2015 that it would support Samsung Pay. Cross-border payments provider Veem, formerly known as Align Commerce, announced an integration with QuickBooks Online, used by small …

Read More »Online Merchants Make Use of More Fraud-Detection Tools, Except 3-D Secure

With concerns about card-not-present fraud rising, e-commerce merchants have increased their usage of 19 of 21 fraud-detection tools since 2010, some by more than 30 percentage points, according to a recent report from the Federal Reserve Bank of Kansas City. The only tool whose usage declined was 3-D Secure, which …

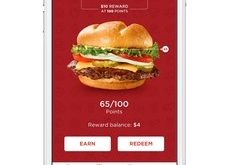

Read More »Punchh’s Loyalty Program, Coupled With Apple Pay, Comes to Three Eatery Chains

Apple Pay users visiting restaurants that are part of Punchh Inc.’s restaurant-loyalty service will be able to earn and redeem points when using the mobile-payment service, Punchh announced Thursday. Smashburger, Quiznos, and MOD Pizza will offer the Apple Pay/Punchh service later this year, Mountain View, Calif.-based Punchhsays. Apple Pay users …

Read More »MRC Notes E-Commerce Fraud Arrests and other Digital Transactions News briefs

• The National Retail Federation announced that senior vice president and general counsel Mallory Duncan plans to retire at the end of August. Duncan joined the trade group in 1994 as general counsel and is a staunch advocate for merchants’ interests on payments issues. He plans to consult on payments and …

Read More »Despite Advances, Security Woes Darken Consumer Attitudes About E-Commerce

A new survey from American Express Co. finds that 37% of consumers abandoned an online purchase because they have concerns about the security of the transaction. The 2017 American Express Digital Payments Survey, released Tuesday, also finds that, despite these concerns, 47% of consumers increased their e-commerce purchasing frequency in …

Read More »Choke Point Figure Moves On and other Digital Transactions News briefs

• Juniper Research released a study estimating retailers globally will sustain $71 billion in card-not-present fraud over the next five years. The firm cites the U.S. move to EMV and “delays” in the arrival of the 3D Secure 2.0 protocol among the reasons for the forecasted losses. • Michael S. Blume, …

Read More »COMMENTARY: Is Open Banking the Beginning of the End for Payment Networks?

By Rick Oglesby and Brad Margol A 2015 European Parliament regulation, EU2015/751, caps the fees that a European cardholder’s bank may charge a merchant’s bank (interchange fees) at 0.2% for debit cards and 0.3% for credit cards. Also passed in 2015, and ramping up to full effect in January of …

Read More »